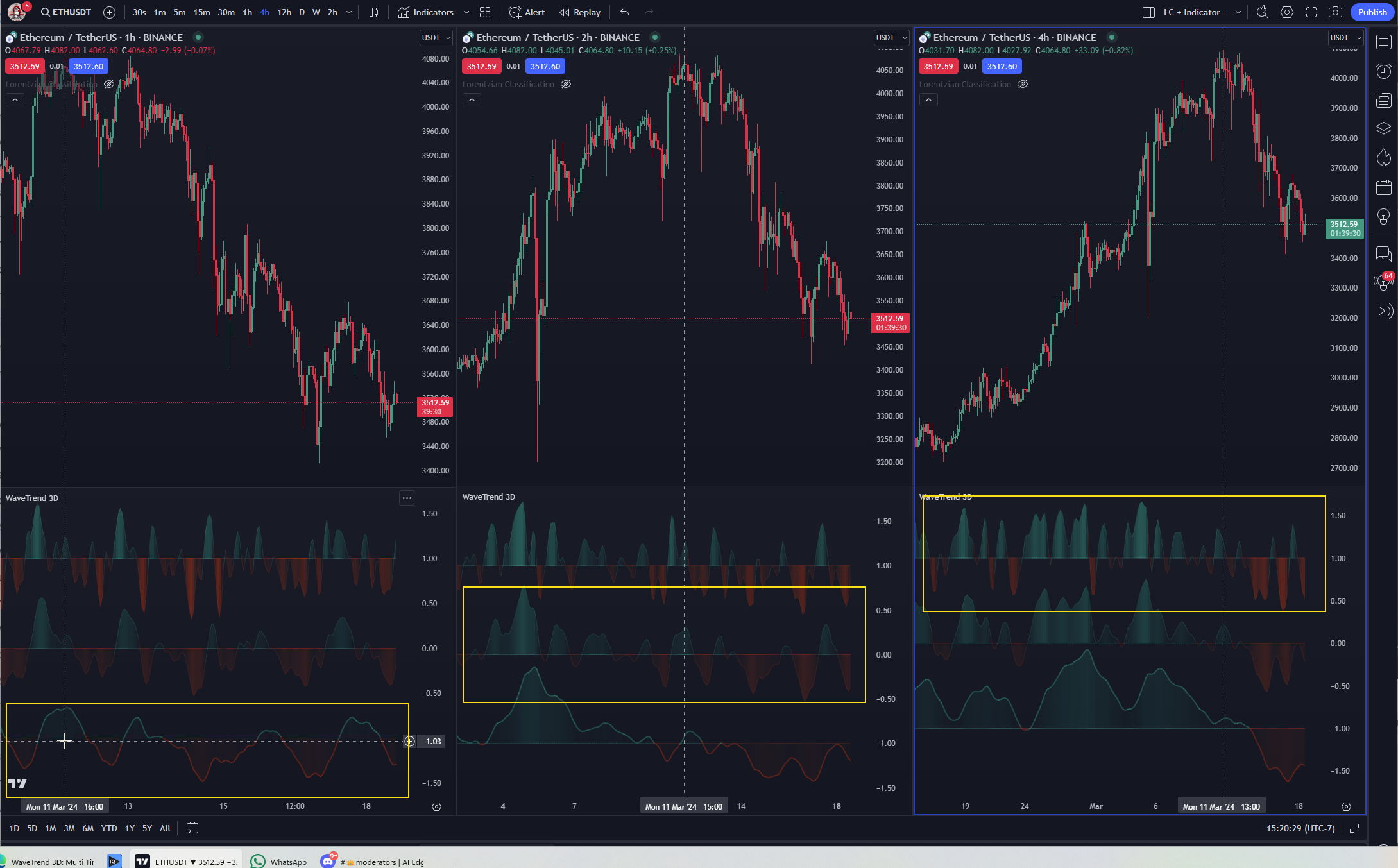

Understanding Core Concepts

While traditional WaveTrend indicators rely heavily on overbought/oversold conditions and single-timeframe divergences, Wavetrend 3D redefines the landscape by stitching together multiple “speeds” (or timeframes) into one harmonized view. Below, we break down key ideas powering Wavetrend 3D.

Multi-Timeframe Oscillators

Why “3D” Matters

Markets don’t move in purely 2D. Trend shifts on a 4-hour chart can overshadow signals on a 1-hour chart. Wavetrend 3D addresses this by blending three oscillators:

- Fast (e.g., ~6-hour on a 12-hour chart)

- Normal (the main timeframe, e.g., 12-hour)

- Slow (a broader perspective, e.g., daily)

|

|---|

| Fig 1: Separate fast, normal, and slow oscillators on different timeframes. |

This reveals how multiple timeframes intersect, highlighting when fast and normal align or conflict with the slow oscillator.

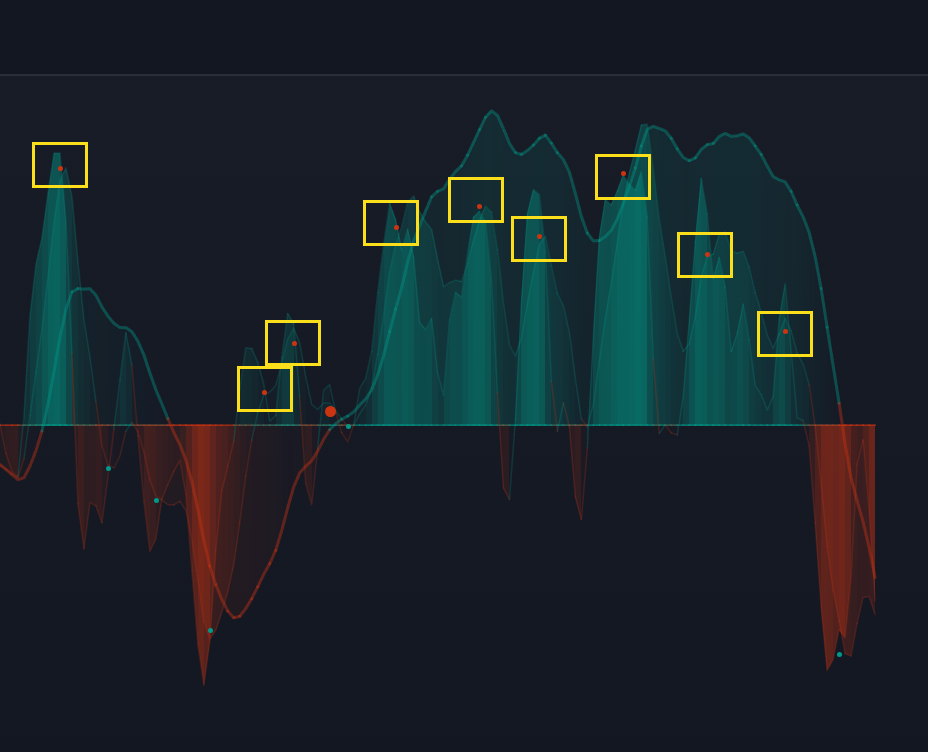

Small Circles & Big Circles

Small Circles (Fast vs. Normal Crosses)

Small circles appear when the fast oscillator crosses the normal oscillator:

- Red Circle Above Zero: Potential bearish correction.

- Green Circle Below Zero: Potential bullish reversal.

|

|---|

| Fig 2: Fast crosses normal above zero, generating a small red circle signal. |

|

|---|

| Fig 3: Fast crosses normal below zero, generating a small green circle signal. |

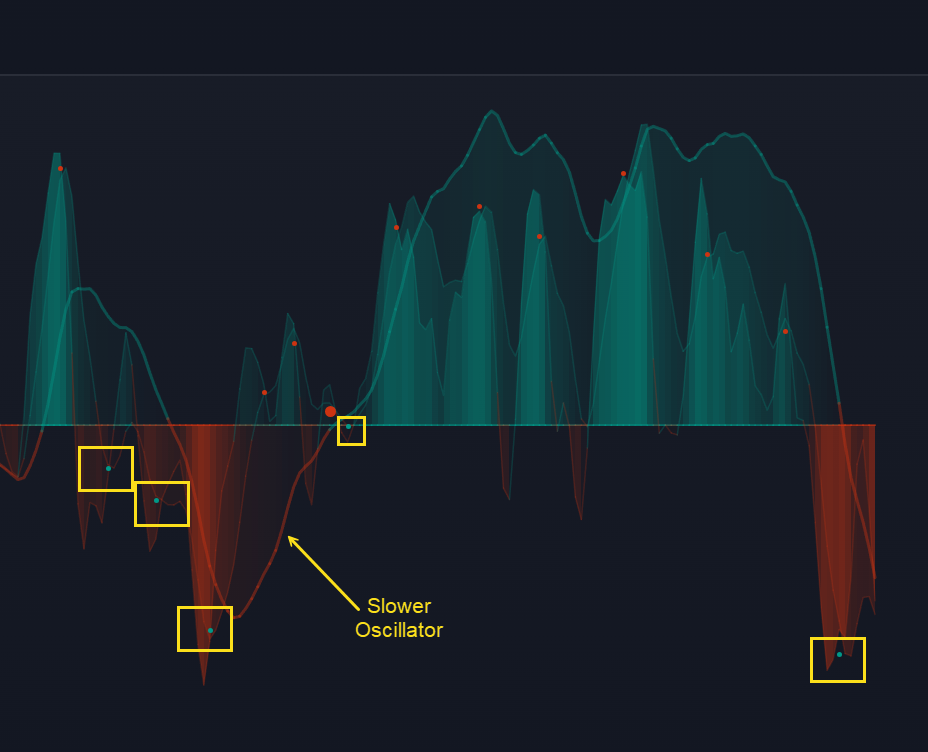

Big Circles (Potential Trigger Waves)

Big circles mark a possible divergence wave—often a reduced-amplitude crossover compared to a prior wave. These can precede stronger moves.

|

|---|

| Fig 4: A bullish trigger wave forming at lower amplitude than a prior bearish wave. |

Mirrored Mode

Mirroring signals across zero provides an alternate lens: bullish oscillations reflect upward, bearish oscillations invert downward.

|

|---|

| Fig 5: Mirrored mode for a different perspective on oscillator alignment. |

|

|---|

| Fig 6: Identifying smaller bullish/bearish “bubbles” within a larger wave. |

Divergence detection can also become clearer in mirrored space.

|

|---|

| Fig 7: A smaller mirrored wave relative to its predecessor often signals an upcoming reversal. |

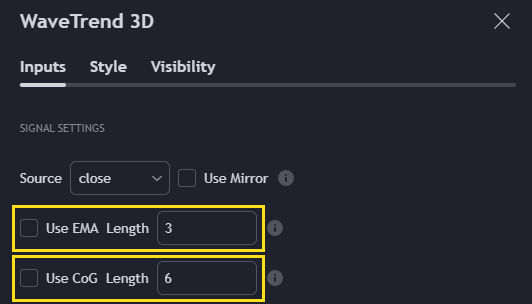

EMA & CoG Smoothing

Exponential Moving Average (EMA)

By default, Wavetrend 3D has optional EMA smoothing. Increasing the EMA Length offers stronger noise reduction, at the cost of slight delay.

|

|---|

| Fig 8: Adjusting EMA length to smooth the oscillators further. |

Center of Gravity (CoG)

CoG is a zero-lag, adaptive smoothing method. Its drastic look can often highlight inflection points earlier.

|

|---|

| Fig 9: CoG smoothing giving a different waveform shape compared to EMA. |

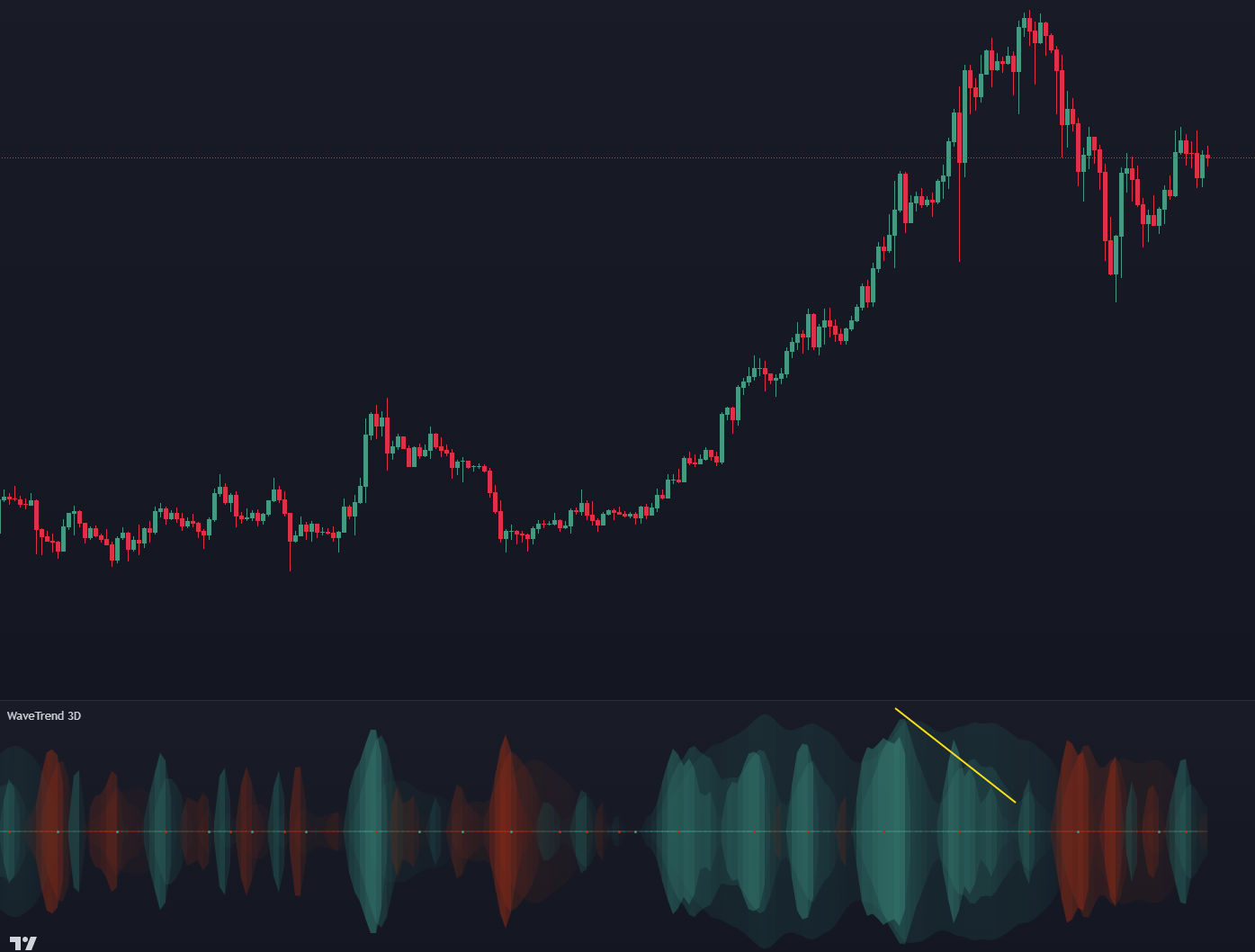

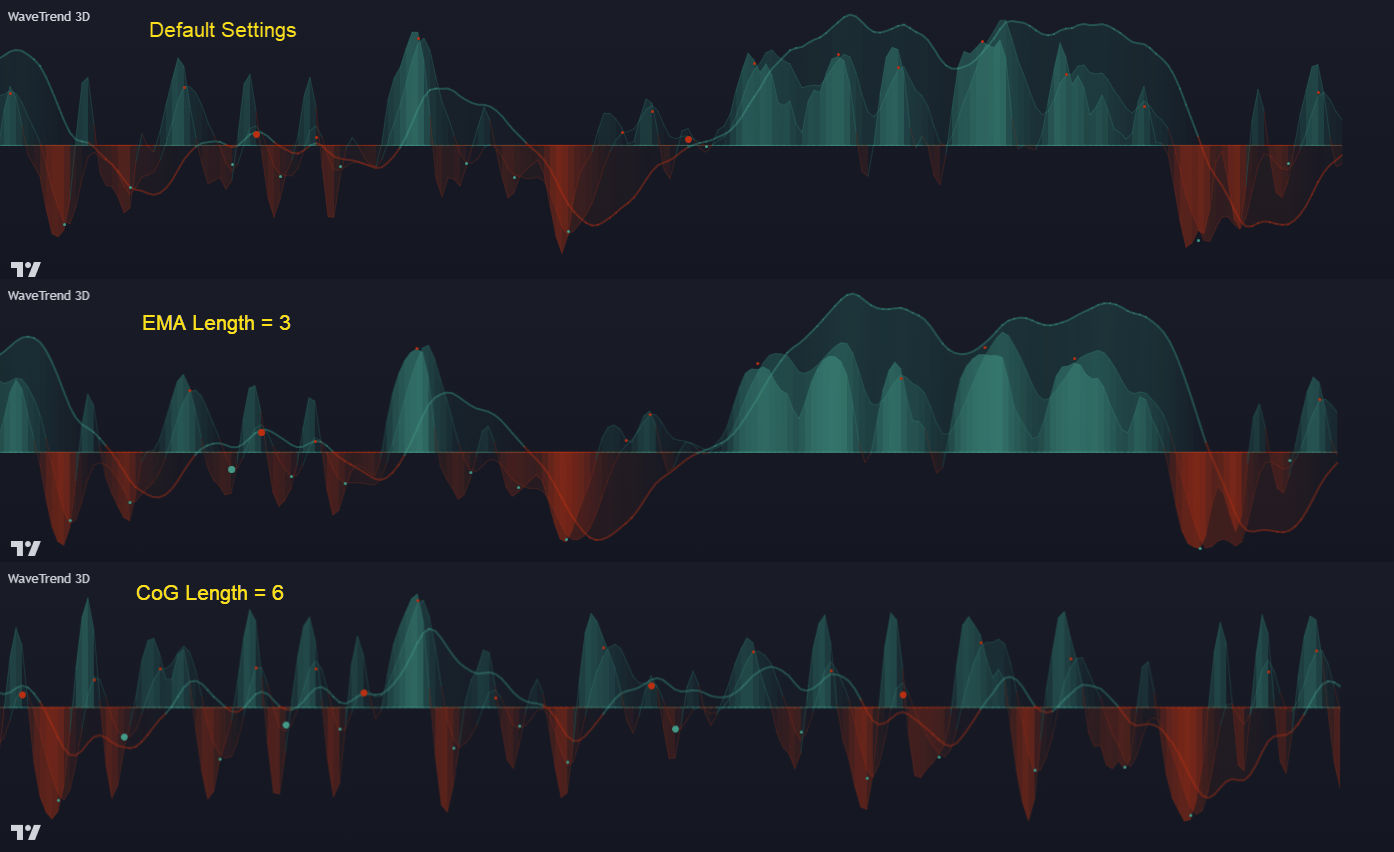

Speed to Emphasize

Select which oscillator (fast, normal, or slow) to emphasize. You can bold it or adjust the width for visual clarity.

|

|---|

| Fig 10: Emphasizing the slow oscillator to spot major regime shifts. |

Crossing the zero line on the slow oscillator can signal a strong trend change.

|

|---|

| Fig 11: Slow oscillator zero-cross events typically mark significant shifts. |

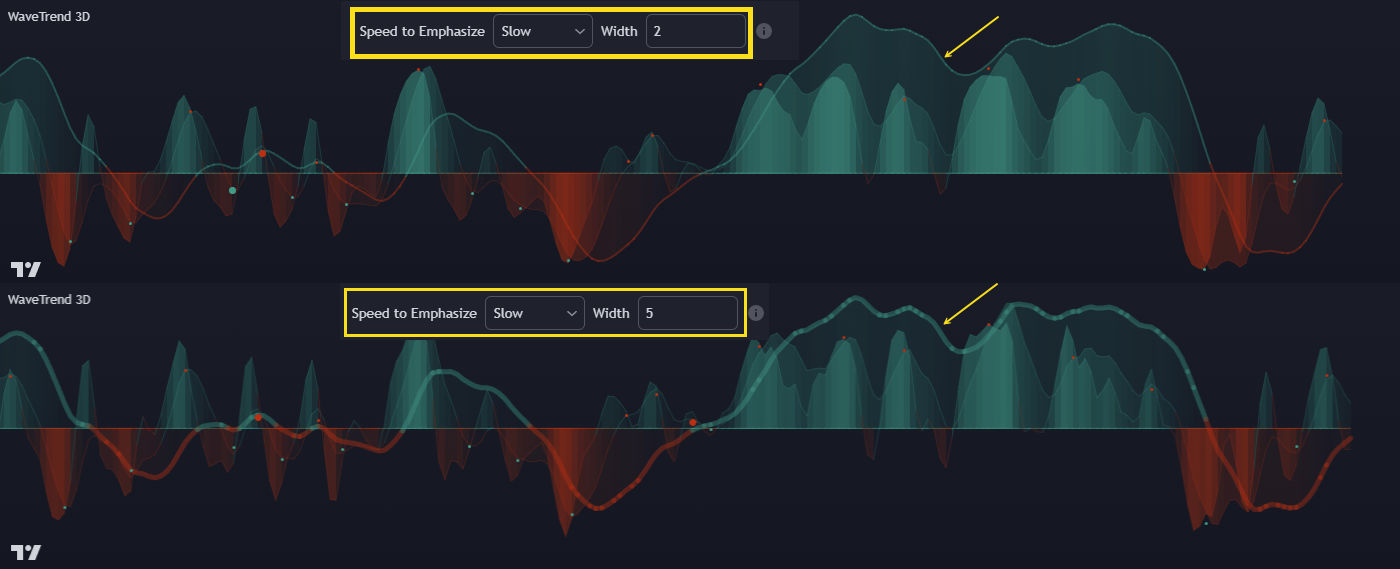

Kernel Estimators

Kernel estimators—particularly Display Kernel Moving Average or Display Kernel Signal—help detect trend bias with minimal lag.

|

|---|

| Fig 12: A kernel ribbon changing colors can signal volatility spikes or market indecision. |

Frequent color changes often correlate with a ranging market.

|

|---|

| Fig 13: Rapid color shifts generally indicate sideways, choppy price action. |

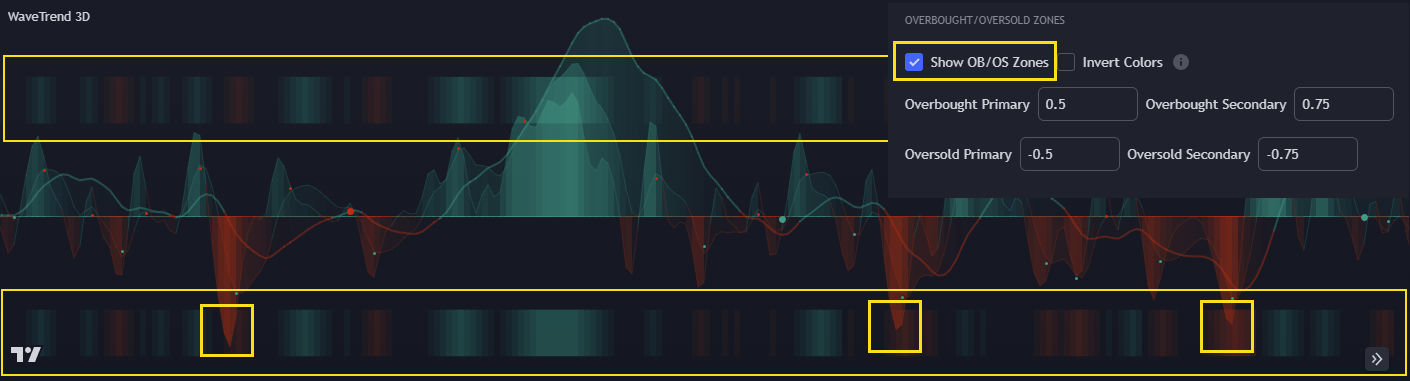

Overbought & Oversold Zones

Since Wavetrend 3D’s oscillators map between -1 and +1, zones around ±0.5 highlight extremes occurring in < 25% of conditions. These aren’t guaranteed “sell” or “buy” triggers—especially if the market transitions to a strong trend—but they’re valuable reversal zones.

|

|---|

| Fig 14: Overbought/oversold thresholds mapped at ±0.5 within a -1 to +1 scale. |

Practical Applications

- Trend Reversals: Watch the slow oscillator crossing zero.

- Multi-Timeframe Confirmation: Align small, normal, and slow oscillators for stronger signals.

- Divergences: Large circle signals often front-run powerful reversals.

- Mirrored Mode Insights: Identify smaller bullish or bearish “bubbles” inside a larger opposing wave.

- Risk Management: Combine Wavetrend 3D with other analysis forms; trailing stop-losses can be keyed to major oscillator pivot points.