Microsoft's Q1 2025: A Symphony of Growth (With a Few Sour Notes)

Microsoft just reported its first-quarter earnings for fiscal year 2025, delivering the kind of quarter Wall Street dreams about: lots of growth, a sprinkle of caution, and enough complexity to keep everyone guessing.

Financial Snapshot

First, let's look at the big picture:

| Metric | Q1 FY2025 | Q1 FY2024 | YoY Change |

|---|---|---|---|

| Revenue | $65.6 B | $56.5 B | +16% |

| Operating Income | $30.6 B | $26.9 B | +14% |

| Net Income | $24.7 B | $22.2 B | +11% |

| Diluted EPS | $3.30 | $2.99 | +10% |

Microsoft delivered a strong first quarter of fiscal 2025, beating Wall Street expectations on both revenue and earnings. Revenue growth of 16% year-over-year isn’t just impressive—it's a testament to Microsoft's ability to fire on all cylinders. This topped consensus estimates of about $64.5 billion. Net income followed suit, rising to $24.7 billion, an 11% increase from $22.2 billion a year ago, providing shareholders with that warm, fuzzy feeling of growth that tech giants love to promise. Diluted earnings per share (EPS) reached $3.30, growing 10% year-over-year (from ~$3.00 in Q1 FY2024) and beating analyst projections of around $3.10. Microsoft’s gross margin also expanded by $5.3 billion (13% YoY) despite massive investments in cloud infrastructure.

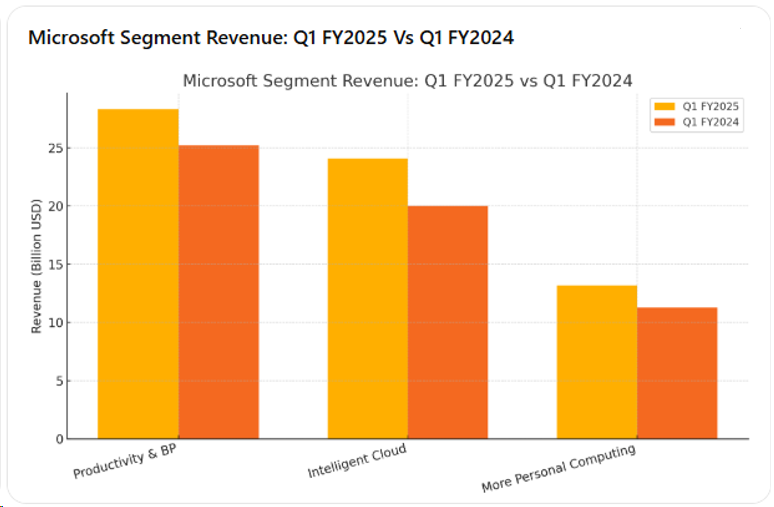

Segment-by-Segment Breakdown

But let's unpack these numbers further, diving into Microsoft’s segments to see where exactly this growth originated:

| Segment | Q1 FY2025 Revenue | Q1 FY2024 Revenue | YoY Rev | Q1 FY2025 Op. Income | Q1 FY2024 Op. Income | YoY OpInc |

|---|---|---|---|---|---|---|

| Productivity & Business Processes | $28.32 B | $25.23 B | +12% | $16.52 B | $14.30 B | +15% |

| Intelligent Cloud | $24.09 B | $20.01 B | +20% | $10.50 B | $8.91 B | +18% |

| More Personal Computing | $13.18 B | $11.28 B | +17% | $3.53 B | $3.69 B | -4% |

Microsoft’s Q1 FY2025 results exceeded expectations, largely due to broad-based growth across all segments. CEO Satya Nadella noted that “AI-driven transformation is changing work…across every role and business process,” highlighting how new AI products are driving customer demand. CFO Amy Hood pointed out the quarter was a “solid start” to the fiscal year, with Microsoft Cloud revenue of $38.9 billion (a subset of total revenue) growing 22% year-over-year. This strong cloud performance, alongside better-than-expected PC and gaming results, contributed to the top-line beat. On the earnings call, Microsoft did issue cautious guidance (which tempered the stock’s immediate reaction), but overall the quarter’s double-digit growth and beats on revenue (+$1.1B) and EPS (+$0.20) vs. consensus underscored robust momentum.

As shown above, each segment’s revenue grew double-digits year-on-year in Q1 FY2025. However, profitability varied – the Productivity and Cloud segments grew operating profits in line with revenues, while More Personal Computing saw a slight decline in operating income despite higher revenue (due to cost increases in that segment). Below we delve into each segment’s performance and drivers:

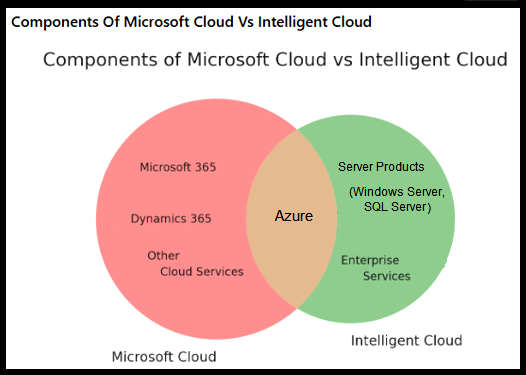

Here’s a Venn diagram illustrating the overlap and unique components:

- Microsoft Cloud only: Microsoft 365, Dynamics 365, Other Cloud Services

- Intelligent Cloud only: Server products (Windows Server, SQL Server), Enterprise Services

- Overlap (both): Azure

This visualization clarifies how Microsoft Cloud encompasses a broader set of SaaS offerings, while Intelligent Cloud focuses on core infrastructure and enterprise services, with Azure at the heart of both.

The Productivity Powerhouse

The Productivity & Business Processes segment (think Office, LinkedIn, and Dynamics) continues to be Microsoft’s reliable cash cow, clocking in steady growth of 12% revenue and an even healthier 15% operating profit jump. Apparently, businesses still need spreadsheets and PowerPoint slides, especially when infused with AI-driven Copilots capable of doing half their job (for a modest extra fee, of course).

Azure's Impressive Ascent

But the real headline-grabber is Intelligent Cloud, spearheaded by Azure’s blistering 33% growth. Microsoft’s colossal $80 billion investment in data centers and AI infrastructure seems to be paying off handsomely. Enterprises and startups alike are flocking to Azure’s AI services faster than people rush for free samples at Costco. Azure's rapid growth suggests Microsoft is successfully drawing businesses and innovators into its ecosystem with the allure of powerful AI-driven services, creating a formidable competitor for Amazon’s AWS and Google Cloud.

Gaming Growth and Integration Challenges

And then there's the More Personal Computing division. Revenues jumped an impressive 17%, driven mostly by a whopping 61% growth in gaming, courtesy of Microsoft finally digesting Activision Blizzard, which catapulted gaming revenues upward by 61%. Yet, operating income here declined by 4%, reflecting the substantial costs associated with such a massive integration.

Navigating Tariffs and Currency Fluctuations

Now, the subtler stuff: tariffs. They're playing a nuanced game in Microsoft's numbers—nudging Windows revenues upward temporarily as PC makers stockpile ahead of tariffs. It’s not a big storm, just a mild breeze. Foreign exchange rates similarly shaved a point or two off growth—unpleasant, but hardly existential for a company this profitable.

Wall Street's Bullish Outlook

Wall Street analysts are practically swooning. Morgan Stanley set their sights on a bullish $482 price target, and Goldman Sachs is humming a similar tune at $480. Jefferies and Wedbush, meanwhile, are even more enthusiastic, whispering targets of $550 and $515 respectively. The stock’s price range this past year ($345 to $468) reflects a market that’s cautiously optimistic, especially given Microsoft’s deft maneuvers in cloud and AI.

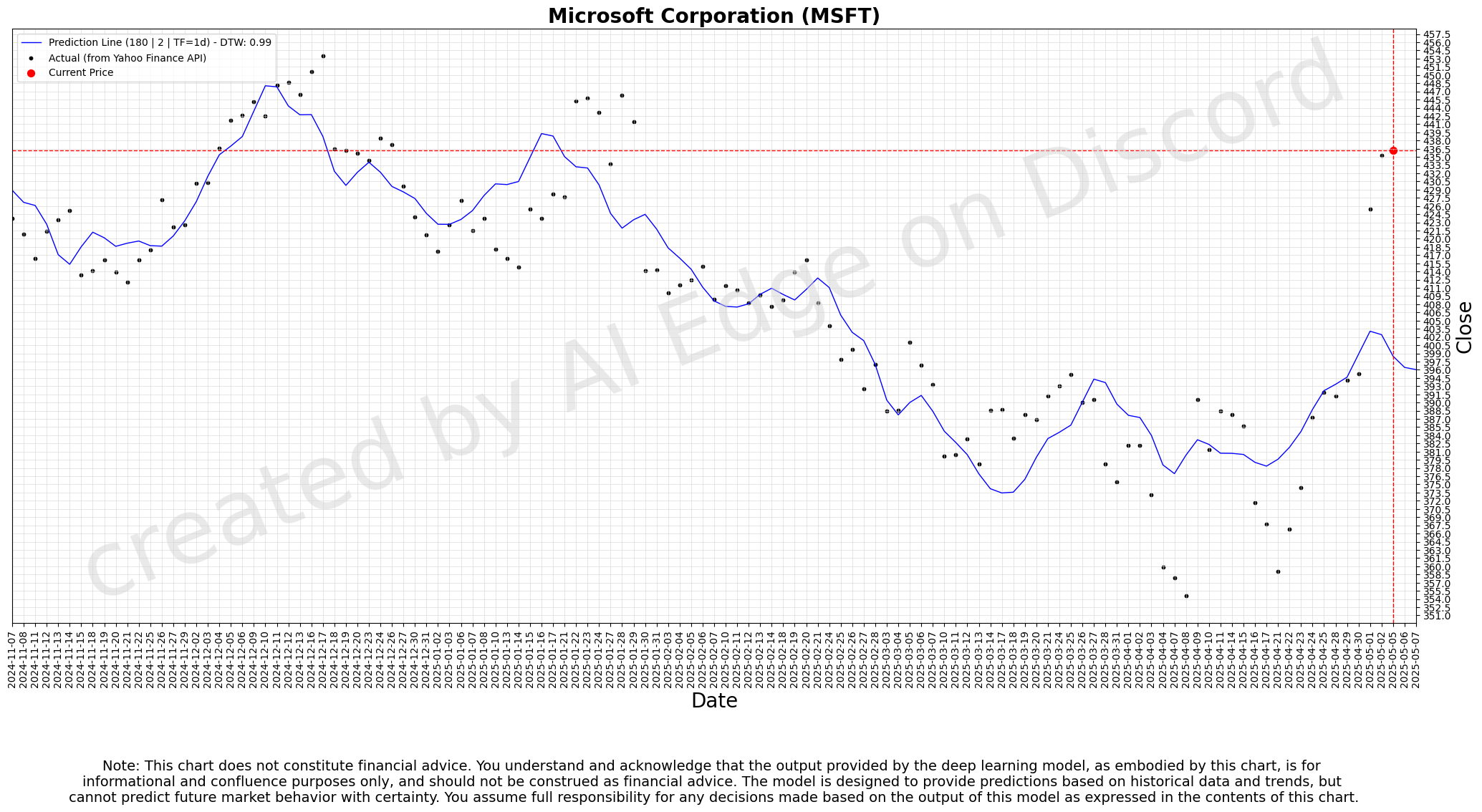

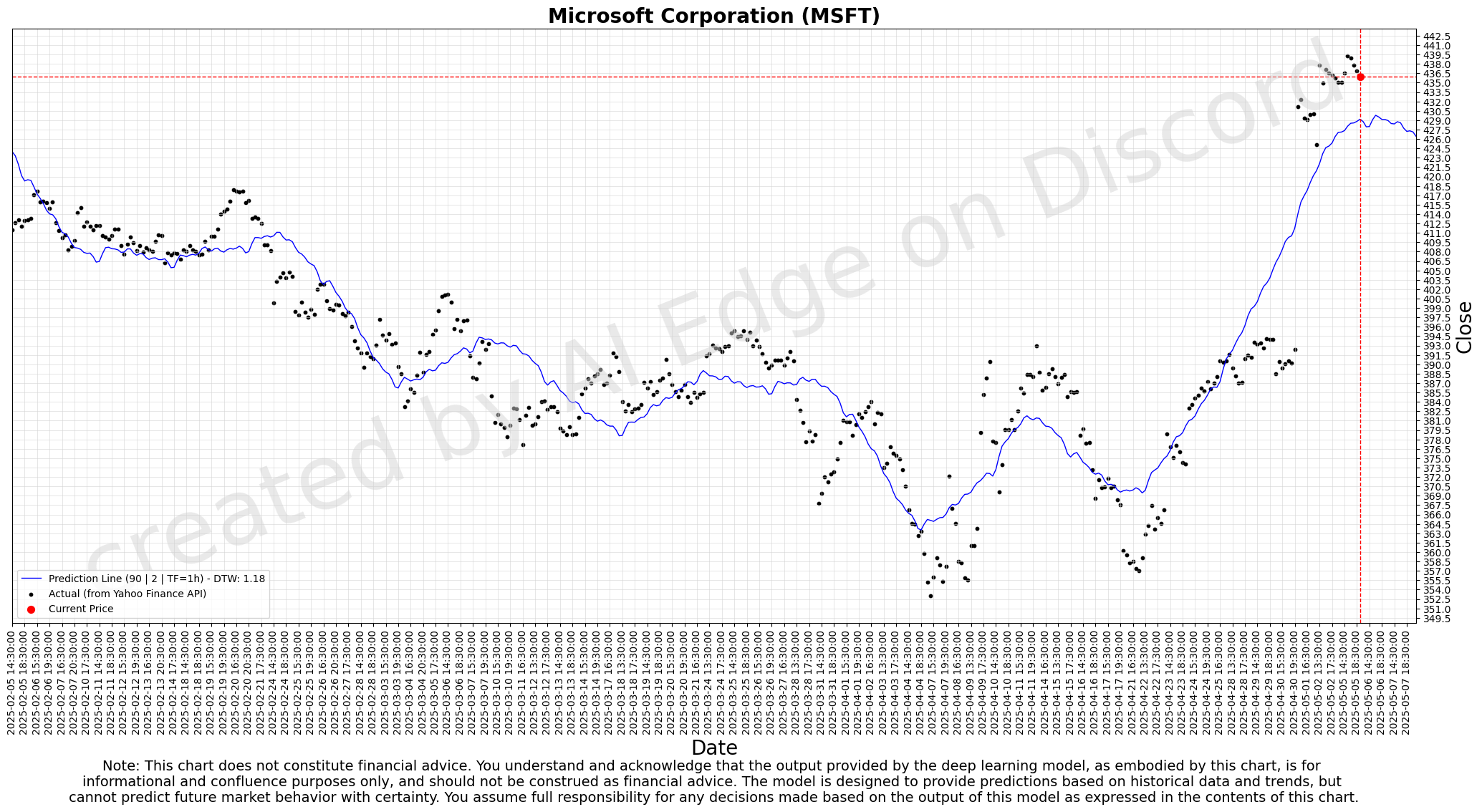

Stock Performance: A Magnificent Ride Amid the Wall of Worry

Over the past year, Microsoft’s stock has reflected its strong results and persistent investor optimism, fluctuating between roughly $345 and a lofty peak of $468. A sharp rally kicked off in late 2024, extending into 2025, driven primarily by excitement around accelerating cloud growth and the seemingly boundless potential of AI. After Microsoft’s impressive Q1 FY25 earnings initially sparked caution-driven jitters, shares quickly found their footing again as subsequent quarters consistently beat expectations. By May 2025, Microsoft's stock comfortably hovered in the mid-$430s, a remarkable 30% climb year-over-year and nearing historic highs.

The stock’s 52-week high around $468 came amid the euphoric reaction to Azure’s AI-powered growth surprising even the most optimistic analysts, pushing the company’s market capitalization toward a dizzying $3.2 trillion. Throughout 2024’s macroeconomic turbulence—marked by stubbornly high interest rates and economic uncertainties—Microsoft stood resilient, widely celebrated as a cornerstone of the famed "Magnificent Seven" tech stocks. Its balanced portfolio spanning enterprise software, cloud computing, and consumer tech provided a critical cushion, outperforming many tech peers facing headwinds. Despite trading at a relatively lofty valuation around 35 times earnings, investors have largely deemed this premium justified given Microsoft's commanding market position and enormous upside from ongoing AI investments. Wall Street’s confidence remains unwavering, with widespread anticipation that Microsoft's strategic bets on AI will continue to translate into meaningful revenue and earnings growth well into the future.

Strategic AI and Cloud Ambitions

At the heart of Microsoft’s future strategy is its aggressive expansion in cloud infrastructure and AI, aiming squarely at competitors AWS and Google Cloud. Microsoft plans an ambitious $80 billion capital expenditure for FY2025 on expanding global cloud infrastructure and AI capabilities, a strategic bet that has seen Azure significantly outpace AWS and Google Cloud in growth rates. Microsoft's partnership with OpenAI has proven transformative, offering enterprises exclusive access to advanced models like GPT-4. The company continues to integrate AI features across its product ecosystem, boosting the attractiveness and revenue potential of platforms like Azure and Microsoft 365. Additionally, Microsoft’s strategic pricing, bundling, aggressive sales incentives, and tailored international offerings position Azure favorably against rivals, reinforcing analyst expectations for sustained high growth in the cloud and AI markets. Strategically, Microsoft continues its artful balance leveraging AI across all software suites to fend off challengers like Salesforce and Google Workspace and using Activision Blizzard to bolster its gaming empire against Sony’s PlayStation dominance. Internationally, Microsoft’s game plan adapts to regulatory landscapes (like Europe’s data privacy obsession) without losing sight of global consistency.

Global Regulatory Adaptations

On the international front, Microsoft adeptly navigates complex regulatory landscapes, particularly Europe's stringent data privacy regulations. By establishing local data centers and offering region-specific solutions, Microsoft maintains global consistency while adhering to local requirements.

Addressing Hardware Weaknesses

For areas that faltered—Surface devices and hardware profitability—Microsoft plans to recalibrate its strategy here, emphasizing premium experiences and high-end market positioning rather than chasing volume.

Future Growth and Strategic Initiatives

Looking ahead, Microsoft appears poised for sustained growth. Upcoming product innovations, continuous improvements to existing offerings, and further integration of AI across its platforms suggest a compelling trajectory. Areas like LinkedIn and Surface, though currently lagging, are expected to see strategic adjustments and new initiatives designed to reignite growth.

Conclusion: Balanced Innovation and Profitability

In essence, Microsoft's Q1 2025 earnings underscore its exceptional ability to balance innovation with profitability. In short, Q1 2025 was Microsoft doing what it does best: strategic brilliance, robust execution, and setting itself up to ride the next wave—this time powered by AI. As Microsoft’s symphony of growth continues to play, Wall Street and investors are humming along, eagerly awaiting the next movement.