Apple Q1 2025 Deep Dive: A Balanced Act Amid Global Uncertainty

Apple kicked off 2025 with characteristic steadiness, delivering record quarterly revenue of $124.3 billion, beating analyst expectations by a whisker. Earnings per share came in at $2.40, ahead of the consensus estimate of $2.35 and comfortably topping last year's $2.18.

Financial Snapshot

Here's the breakdown in a tidy table:

| Metric (GAAP) | Q1 2025 | Q1 2024 | YoY Change |

|---|---|---|---|

| Revenue | $124.3B | $119.6B | +4.0% |

| Operating Income | $42.83B | $40.37B | +6.1% |

| Net Income | $36.33B | $33.92B | +7.1% |

| Diluted EPS | $2.40 | $2.18 | +10.1% |

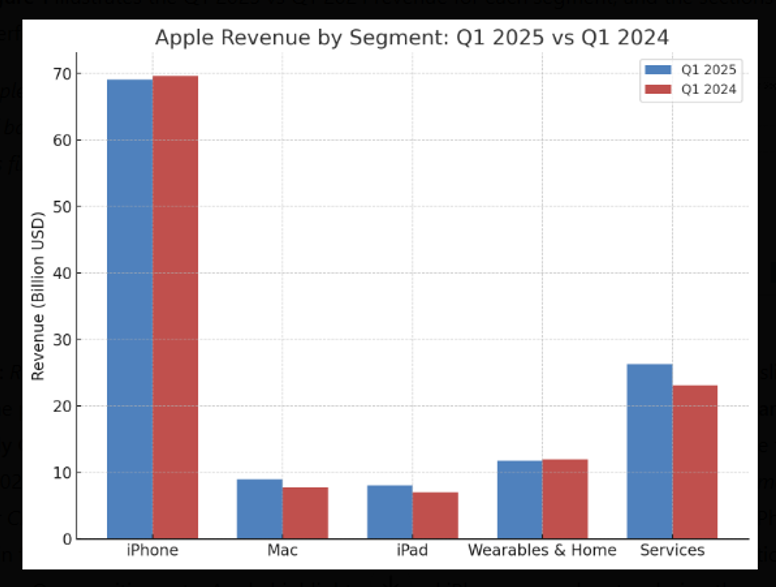

Segment-by-Segment Snapshot

Here's the segment revenue illustrated clearly:

Apple's performance was uneven yet resilient across segments:

iPhone: Slight Miss, Tough Market Conditions

Revenue slipped to $69.14 billion from last year’s $69.70 billion - a minor but notable 0.8% decline. Not exactly a disaster, but it indicates Apple’s facing headwinds, particularly in Greater China where revenue took an 11% hit. Management cited "market saturation and softer demand" as factors. Despite the much-hyped launch of the iPhone 15, sales narrowly missed analysts’ expectations of around $70.7 billion. The silver lining? Record upgrade rates and enthusiastic consumer responses hint that demand remains robust under the right conditions, but clearly, the iPhone juggernaut has its work cut out.

Mac: Rebounding with Silicon Power

Mac revenues surged 15.5%, jumping to $8.99 billion from a softer $7.78 billion in Q1 2024. After last year’s struggles tied to weak demand and a quiet product cycle, the launch of new M3-powered MacBook Pros reignited consumer interest. Apple Silicon continues to provide a serious competitive edge—offering the kind of performance and efficiency that compels buyers even amid broader PC market sluggishness. Clearly, when Apple innovates, the Mac performs.

iPad: Solid Comeback Story

The iPad segment showed resilience, growing 15.2% year-over-year, with revenue hitting $8.09 billion compared to last year's $7.02 billion. The rebound owes itself to improved supply conditions and refreshed models like the updated iPad Air and mini. Apple's decision to position iPads as productivity powerhouses, boosted by seamless accessory integration (hello, Magic Keyboard), continues to pay dividends.

Wearables, Home & Accessories: Plateauing After Growth Spurt

Revenues in this mixed bag category dipped slightly, from $11.95 billion to $11.75 billion, reflecting a modest 1.7% year-over-year decline. After strong growth previously driven by new products (Series 9 Apple Watch, refreshed AirPods), the category now faces tougher comps and tighter consumer wallets. Competition from Samsung and Google’s wearables, coupled with Apple's minimal price adjustments, also contributed to this softness. Still, upcoming innovations like the Vision Pro headset promise future excitement.

Services Steal the Spotlight (and Your Monthly Payments)

Apple's Services division hit another all-time revenue high, soaring nearly 14% to $26.34 billion. What's fueling this impressive jump? Look no further than price bumps on fan favorites like Apple TV+ and Apple Arcade, combined with an ever-growing base of loyal subscribers hooked on the App Store, cloud storage, and AppleCare services. CFO Kevan Parekh pointed out that the installed base of Apple devices reached record levels, meaning more customers than ever are happily clicking "subscribe." Now accounting for roughly 21% of Apple's total revenue, this recurring high-margin stream is increasingly crucial, smoothing out the ups and downs of hardware sales.

Bottom Line: Balanced but Vigilant

Overall, Apple’s gains in Services, Mac, and iPad comfortably offset minor declines in the iPhone and Wearables segments, securing another record revenue quarter. Management attributes the strong performance primarily to the "power of Apple Silicon" and a diversified portfolio, though they remain watchful of specific weaknesses, notably within the crucial China market. Apple is steady for now—but challenges are clearly on the radar.

Impact of Tariffs and Trade Dynamics: Navigating Global Uncertainty

Apple’s latest earnings reflect an increasingly significant impact from tariffs stemming from ongoing U.S.-China trade tensions. CEO Tim Cook noted that, despite proactive supply-chain adjustments—shifting iPhone assembly primarily to India and utilizing Vietnam for other products—Apple still anticipates approximately $900 million in extra costs next quarter. Although Cook described this scenario as relatively favorable given the challenging geopolitical environment, continued tariffs on accessories and AppleCare components highlight persistent margin pressures.

Analysts view this anticipated cost increase as manageable, representing around 0.7% of Apple's annual revenue, but caution remains. Apple’s strategic adjustments mitigate some risks, but as Cook acknowledged, uncertainties in global trade policies mean future impacts remain unpredictable, keeping investors and executives closely attuned to geopolitical shifts.

Q1 2025 Filings: Key Highlights and Takeaways

Apple's Q1 2025 filings provide key insights:

- Strong Capital Returns: Apple delivered big for shareholders, returning over $30 billion this quarter, including $23.6 billion in share buybacks and $3.9 billion in dividends. These repurchases notably boosted earnings per share.

- Record Installed Base: Apple’s ecosystem hit a new all-time high for active devices, setting the stage for robust service revenues and future growth through device upgrades.

- Focused Investment: Operating expenses rose modestly by 6.6% to $15.44 billion, driven primarily by increased R&D spending, up to $8.27 billion. This underscores Apple’s continued commitment to innovation in silicon technology, AI, and AR.

- Cautious Optimism: Apple refrained from specific financial guidance but hinted at steady revenue growth ahead ("low to mid-single digits"), despite ongoing macroeconomic and currency uncertainties.

- Confident Leadership Commentary: CEO Tim Cook celebrated Apple’s "best quarter ever," praising the strength of their product lineup and highlighting advances from Apple Silicon and AI capabilities. CFO Kevan Parekh echoed the sentiment, emphasizing the quarter’s strong revenue and profitability.

Overall, Apple remains financially robust, strategically proactive, and cautiously optimistic despite external headwinds.

Wall Street Verdict: Analysts Remain Bullish but Cautious

After Apple’s solid yet unspectacular Q1 2025 earnings report, Wall Street analysts mostly remained upbeat, albeit tempered by caution around China and tariff risks.

Wedbush Sees Sky-High Potential

Dan Ives at Wedbush upped his price target from $250 to $270, emphasizing increased confidence as Apple's production shifts to India ease tariff fears. He even floated a $4 trillion valuation under the most bullish scenario.

Morgan Stanley Optimistic, but Watchful

Erik Woodring raised Morgan Stanley’s target first to $235, then adjusted to $252, citing macro uncertainties and China demand softness. Still, Morgan Stanley maintains a positive outlook, highlighting strong support near the $200 mark.

J.P. Morgan: "Stay Invested"

Samik Chatterjee at J.P. Morgan initially set an ultra-bullish $300 price target, expressing high confidence in Apple's product pipeline and AI developments. Despite later adjustments to mid-$200s, JPM remains upbeat about long-term prospects.

Mixed Signals from Other Analysts

Rosenblatt downgraded Apple to Neutral ($217), concerned by high valuation and China exposure. Jefferies stayed cautious at Underperform ($170). Conversely, Evercore ISI upgraded its outlook to $275, and Argus Research moved Apple up to Strong Buy post-earnings.

Consensus and Looking Ahead

Overall, analysts praised Apple’s resilience in Services and margins, despite cautious sentiment regarding China and tariff pressures. There's considerable excitement around upcoming innovations, notably the Vision Pro AR headset and AI enhancements. Despite near-term hurdles, most analysts see ample upside, maintaining a consensus price target around $235.

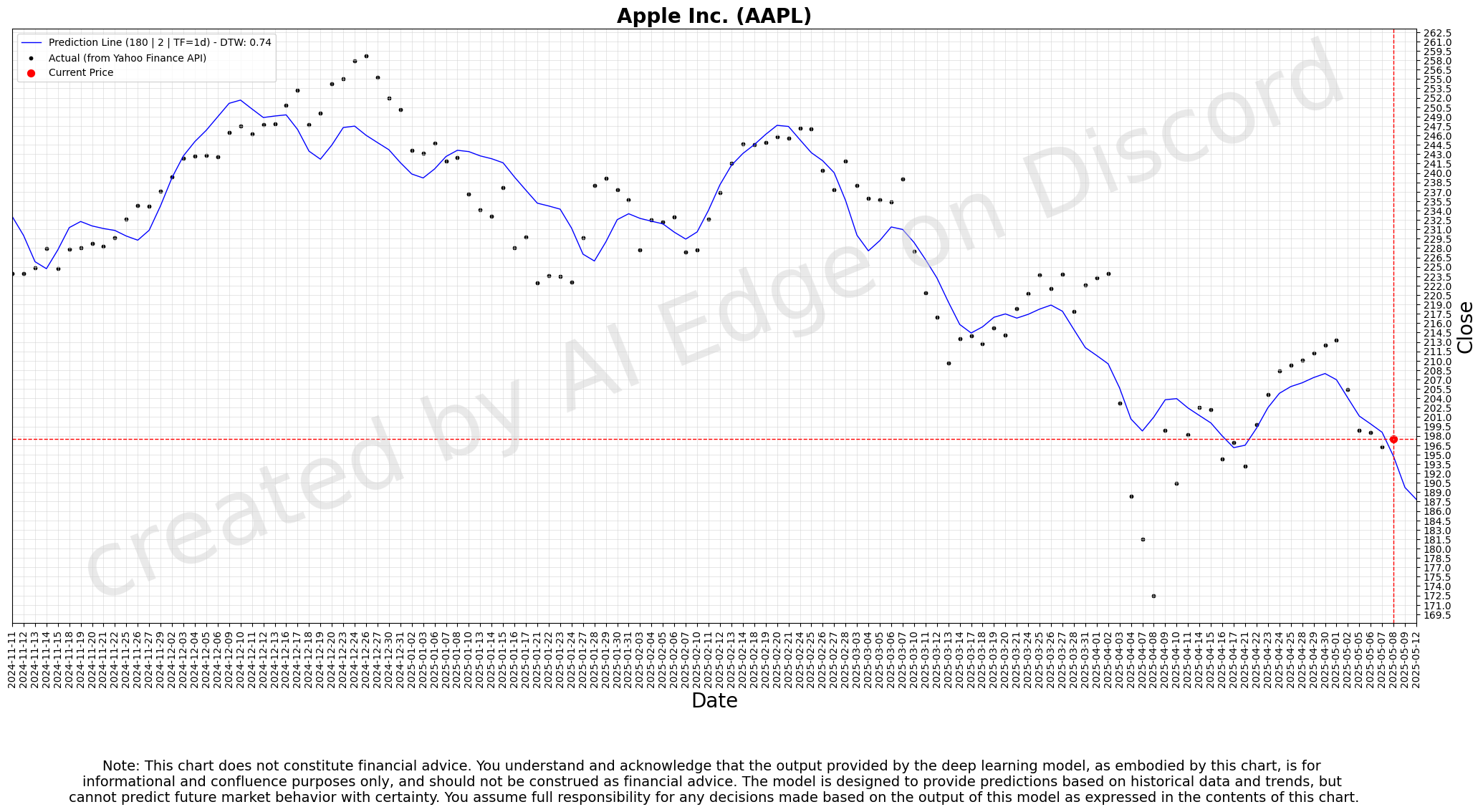

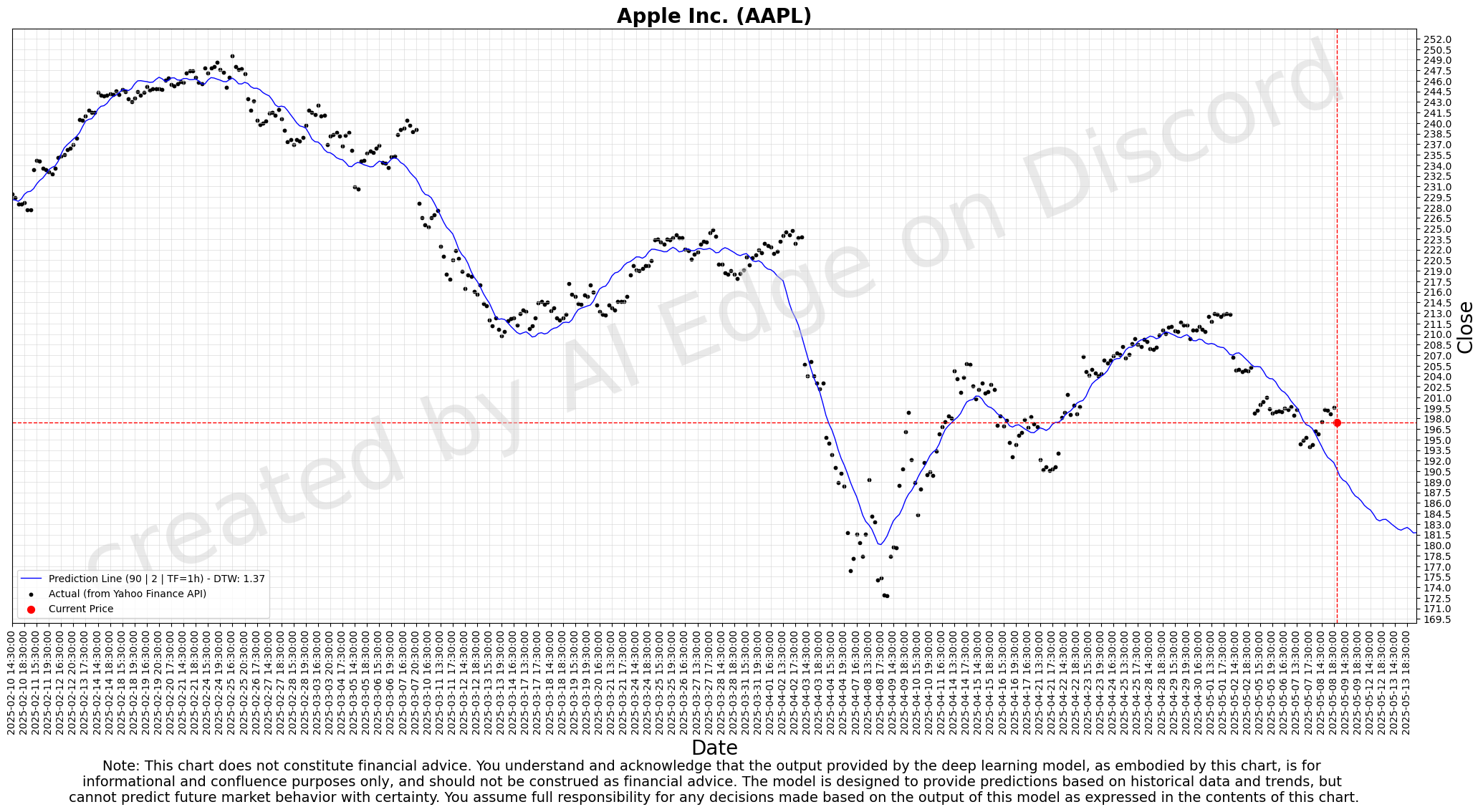

Riding Apple's Rollercoaster: Stock Performance in Focus

Apple’s stock (NASDAQ: AAPL) had quite the ride over the past year, swinging between a low of $169 and an all-time high of $260.10 amid the tech frenzy in mid-2024. Despite record earnings reported in Q1 2025, Apple’s shares remained cautious, hovering around $190–$200, reflecting muted enthusiasm due to ongoing concerns over China and tariffs. By May 2025, the stock found its footing near $205–$210, stabilizing its market cap back around $3 trillion. With investors carefully weighing Apple’s slower short-term momentum against its formidable long-term resilience, the stock remains steady—down slightly from recent peaks but maintaining solid year-on-year gains of about 30%, pointing toward cautious optimism moving forward.

Apple’s Global Strategy Playbook: Navigating Mature and Emerging Markets

Apple's geographic strategy is a finely tuned balancing act between nurturing mature markets like the U.S. and Europe and aggressively tapping growth potential in emerging markets such as China and India. In the U.S., Apple's dominance hinges on an ecosystem that keeps customer loyalty sky-high, bolstered by attractive financing and trade-in programs, strategic product bundling, and significant domestic investments like a $430 billion initiative, including chip production partnerships.

China presents a tougher scenario, marked by an 11% revenue decline due to fierce local competition, especially from Huawei's resurgence. Apple's response has been strategic localization—enhancing compatibility with key local apps and expanding retail presence while simultaneously diversifying production to India and Vietnam to minimize geopolitical risk.

India is emerging as Apple's next big play, offering enormous potential with a rapidly expanding middle class. Apple’s successful strategy here includes strategic price accessibility via financing and legacy models, combined with significant local production boosts to dodge tariffs and align with the "Make in India" initiative. Europe remains a solid growth story with an impressive 11% revenue increase driven by strong iPhone 15 sales, smart compliance with stringent EU regulations, and investments in local content and manufacturing capabilities. In other regions like Japan and Southeast Asia, Apple continues leveraging tailored market strategies to maintain high market shares and tap affluent segments, emphasizing its premium ecosystem and localized outreach.

Apple's Playbook: Premium Innovation Meets Strategic Pricing

Apple's 2024-2025 strategy underscores innovation at the premium end, notably with the high-performing iPhone 15 lineup and powerful Mac updates featuring the revolutionary M3 chip. The iPhone 15's standout enhancements, including USB-C charging and advanced cameras, solidified Apple's top position, capturing 7 of the top 10 best-selling smartphones globally. Meanwhile, Mac sales surged thanks to Apple Silicon's power and efficiency, pushing Macs further ahead of traditional PC rivals like Dell and Microsoft.

Apple's ecosystem approach, including strategic pricing tiers across iPads, wearables, and services, continues to lock customers into its ecosystem. The imminent launch of the high-end Vision Pro AR headset illustrates Apple's bold innovation strategy, aiming to set industry benchmarks in spatial computing. However, competition from Samsung's Galaxy series and Huawei's resurgence in China, coupled with growing AI integration from rivals, highlights the urgency for Apple to enhance its AI offerings—an area where the company remains cautiously deliberate rather than aggressively pioneering.

Looking Ahead: Areas for Improvement

Critical improvement areas include:

- China strategy: Needs immediate attention to reverse declining iPhone sales.

- AI innovation: Apple trails competitors in generative AI—rapid development and deployment are essential.

- Broader market accessibility: Possibly updating the iPhone SE and strategically adjusting pricing tiers.

- Supply chain resilience: Further diversification and ensuring smooth scale-up of new product categories like Vision Pro.

Apple's Roadmap Ahead: Innovation, Adaptation, and Execution

Looking forward, Apple is set on reinforcing its strengths—innovation, ecosystem cohesion, and booming services—while strategically addressing persistent challenges such as tariff pressures and sluggish performance in China. Management confidently emphasizes their unwavering commitment to innovation, viewing current hurdles not as barriers but as areas ripe for improvement and growth.

With robust annual revenues nearing $200 billion and weekly profits surpassing $2.4 billion, Apple clearly has the financial muscle to tackle these strategic priorities head-on. The company's upcoming product lineup promises exciting refreshes, including the anticipated iPhone 16, Apple Watch Series 10, and cutting-edge M4 Macs. Additionally, potential new ventures like AR/VR advancements and ongoing car project explorations underscore Apple's ambitious vision.

By effectively navigating these dynamics and leveraging its substantial resources, Apple aims to maintain its status as the world's most valuable company, building steadily upon its record-setting Q1 2025 performance.