Alphabet's Q1 2025: AI, Ads, and the Art of Not Panicking

Imagine you're a trillion-dollar tech behemoth navigating a world where AI is both your golden goose and your existential threat. Welcome to Alphabet's first quarter of 2025. Alphabet’s first quarter of 2025 has given us plenty to scribble about, with surprisingly robust earnings, a wave of new AI products, and just enough tariff-related drama to keep things interesting. Despite facing regulatory headwinds and macroeconomic uncertainties, the company delivered impressive financial results, underscoring its resilience and adaptability.

Alphabet Defies Gravity

Alphabet beat expectations pretty handily this quarter. Revenues clocked in at $90.23 billion, comfortably ahead of Wall Street’s $89.2 billion forecast. Earnings per share leaped dramatically to $2.81, which, compared to the anticipated $2.01, felt like Google had quietly perfected a money-printing algorithm (or at least, monetization via AI-enhanced search results). Revenue rose 12% from the prior year—quite the feat for a company whose core business (ads) seemed saturated just a year ago.

Here's the Full Financial Picture:

| Metric | Q1 2025 | Q1 2024 | YoY Change |

|---|---|---|---|

| Revenue | $90.23 billion | $80.54 billion | +12% |

| Operating Income | $30.61 billion | $25.47 billion | +20% |

| Operating Margin | 34% | 32% | +2 pp |

| Net Income | $34.54 billion | $23.66 billion | +46% |

| Diluted EPS | $2.81 | $1.89 | +49% |

| Constant Currency Rev. | +14% YoY | +16% YoY | — |

| Employees (period-end) | 185,719 | 180,895 | +2.7% |

| Free Cash Flow (TTM) | $74.9B | $74.9B | — |

| Capital Expenditures (TTM) | $57.7B | $57.7B | — |

| Dividend per Share | $0.21 | $0.20 | +5% |

| Stock Buyback Authorization | $70B | — | New |

AI: Alphabet’s Not-So-Secret Weapon

The earnings report was practically an AI fest, with Alphabet touting the success of its Gemini 2.5 AI model, now powering "AI Snapshots" in search results. This enhancement reportedly engaged about 1.5 billion users monthly in Q1 alone, a figure that sounds more like an internet fever dream than corporate reality. CEO Sundar Pichai’s tone during earnings discussions could be best described as a restrained celebration: Alphabet’s AI-driven strategy was not only maintaining search’s dominance but apparently enhancing it.

Segment Wars

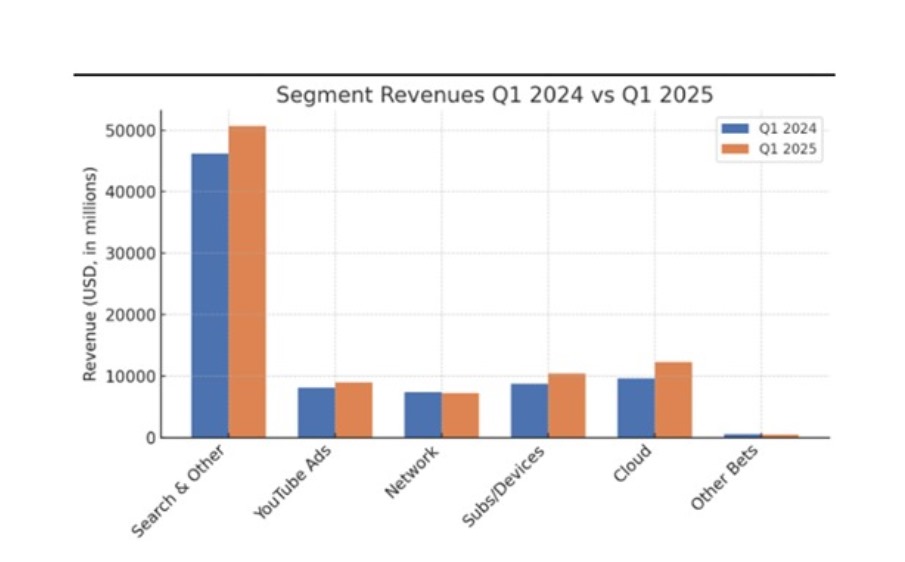

The breakout star? Google Cloud. Revenue soared 28% year-over-year, hitting $12.3 billion, and achieving a level of profitability previously thought mythical for Google’s eternally promising cloud division. Alphabet credited surging enterprise demand for AI-driven workloads, effectively turning Google Cloud into the company’s new growth darling. On the flip side, the Google Network (ads served on partner sites) was the only dark cloud, shrinking by 2% due to the ongoing privacy war on third-party cookies and heightened competition.

Segment Breakdown:

| Segment | Q1 2025 | Q1 2024 | YoY Change |

|---|---|---|---|

| Google Search & Other | $50.70 billion | $46.16 billion | +10% |

| YouTube Advertising | $8.93 billion | $8.09 billion | +10% |

| Google Network (Ads on partner sites) | $7.26 billion | $7.41 billion | –2% |

| Google Subscriptions, Hardware & Other | $10.38 billion | $8.74 billion | +19% |

| Google Services Total | $77.26 billion | $70.40 billion | +10% |

| Google Cloud | $12.26 billion | $9.57 billion | +28% |

| Other Bets | $0.45 billion | $0.50 billion | –9% |

| Hedging Gains | $0.26 billion | $0.07 billion | — |

Google Cloud: Finally Raining Cash

While AWS and Azure grumble about “macro” headwinds, Google Cloud sped up to 28% growth, hitting $12.3 billion in revenue and chalking its second straight quarter of operating profit. Enterprises chasing generative-AI workloads like kids chasing ice-cream trucks discovered TPU v5p and Vertex AI. Google’s beefed-up salesforce (Google Docs now ships with a “Have you considered moving to GCP?” tooltip) finally paid off.

Google Search: The AI Meteor That Didn’t Strike

Remember when ChatGPT was going to vaporize Google Search? Instead, Search revenue still rose 10 percent to $50.7 billion. Google’s “Search Generative Experience” sprinkled Gemini answers atop the old ten-blue-links and users, far from revolting, clicked with gusto. Query volume grew; click-through rates improved; Bing remains the guy in the rom-com who tries a dramatic confession midway through Act II and is politely ignored.

YouTube: Resurrection by Shorts

Last year YouTube looked like a pandemic hangover cue. Now ad revenue is up 10 percent to $8.93 billion. TikTok envy finally paid off: Shorts monetization matured, direct-response formats clicked, and brands rediscovered their wallets. Product tweaks (shopping ads that actually shop) boosted Return on Ad Spend (ROAS) enough that CMOs stopped doom-scrolling long enough to sign Insertion Orders (IOs).

Network Ads: The Cookie That Crumbled

The one negative number: Google Network revenue slipped -2 percent to $7.26 billion. Third-party cookies are in witness protection, Privacy Sandbox keeps rewriting its memoirs, and publishers are panicking about $10 billion of vanishing Cost per Mille (CPMs). Advertisers redirected budgets toward walled gardens that still know your dog’s birthday. Google promises new privacy-safe APIs; skeptics note they promised the same thing last earnings call and the one before that.

Subscriptions & Hardware: Pixels and Nest Eggs

“Subscriptions, platforms, and devices” jumped 19 percent to $10.4 billion. Two main culprits: (1) Pixel 8 sold well through the holidays and into Q1, enough that even the Android press noticed; (2) price hikes on YouTube Premium and YouTube TV stuck, because apparently we will pay anything to avoid a second pre-roll.

Other Bets: Burning Cash, Expanding Robotaxis

Other Bets revenue fell to $450 million, losses widened to $1.23 billion. Waymo raised another $5.6 billion and bragged about launching in new cities, which sounds less like a business model and more like unlocking boss levels in Crazy Taxi. Verily kept spending on clinical trials; investors kept squinting at spreadsheets, looking for “eventual synergies” the way medieval alchemists looked for gold.

Margins: The Ghost of Cost-Cutting Past

Alphabet is still digesting 2024’s layoffs and office-space trims, but severance plus real-estate write-downs only dinged Alphabet-level costs by about $3 billion. Meanwhile, “Other Income” ballooned thanks to an $8 billion unrealized gain on a private-company stake (rumor: SpaceX). If markets ever fall, that line item may reverse harder than a Waymo safety driver.

AI: The Double-Edged Sword

Alphabet's AI endeavors are both its crown jewel and its Achilles' heel. The company rolled out Gemini 2.5, its most advanced AI model to date, boasting 1.5 billion monthly users for AI Overviews in Search. This integration has not only enhanced user engagement but also maintained monetization rates comparable to traditional search ads.

However, the $75 billion earmarked for AI infrastructure in 2025 has raised eyebrows. Critics question whether such hefty investments are sustainable, especially when competitors like OpenAI and Perplexity are developing efficient AI models at a fraction of the cost.

Capital Allocation: Investing in the Future

Alphabet's capital expenditures reached $17.2 billion in Q1 2025, a 43% increase year-over-year, primarily directed towards AI infrastructure and data centers. Additionally, the company announced a $70 billion stock buyback program and increased its quarterly dividend by 5% to $0.21 per share, reflecting confidence in its financial stability and commitment to shareholder returns.

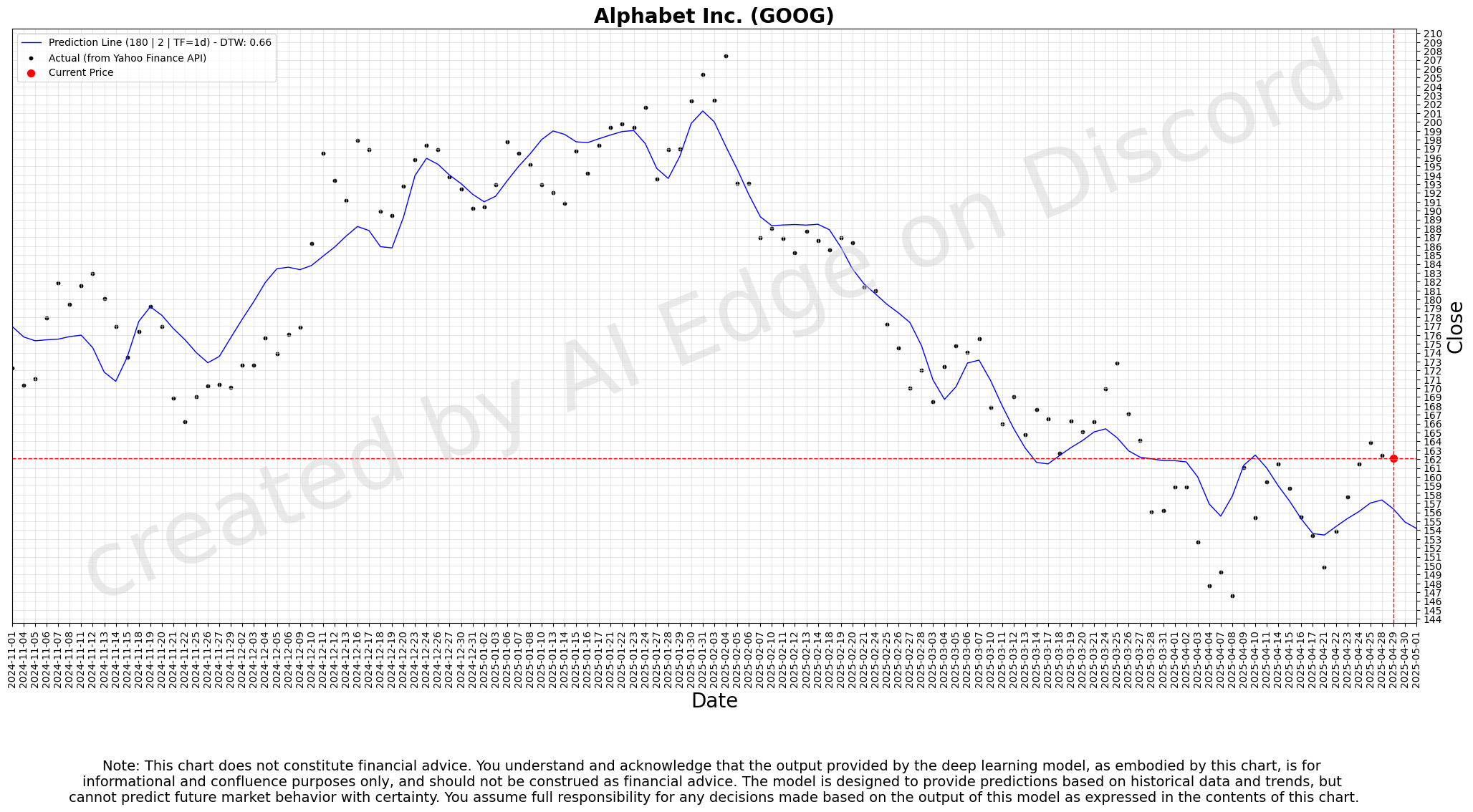

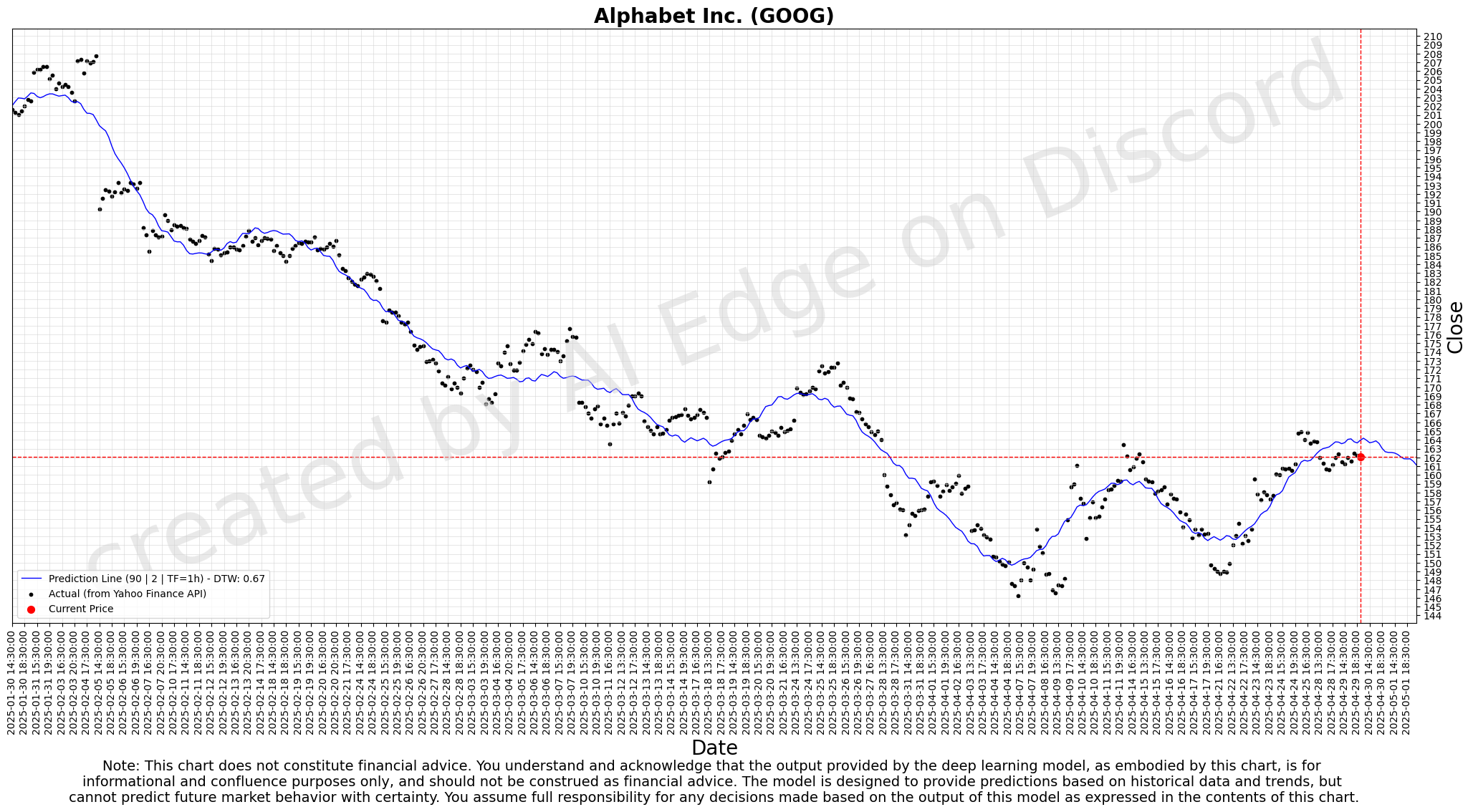

Wall Street's Verdict: Cautious Optimism

Analysts are walking a tightrope between enthusiasm and caution. Analysts have responded positively to Alphabet's performance, with several raising their price targets. However, some analysts urge caution due to potential macroeconomic headwinds and regulatory challenges, including antitrust lawsuits and global tariff implications.

- Bernstein Research: Described the quarter as "pristine" but highlighted concerns over increased costs from employee stock grants, depreciation, and legal matters. Raised the price target from $165 to $185.

- Citi: Emphasized Google's resilience, stating that Search would be "among the last platforms to experience macro impacts and among the first to recover." Set a price target of $195.

- Morgan Stanley: Cited "AI-driven platform-level innovation" as a reason for confidence in long-term growth, with a price target of $185.

- J.P. Morgan: Maintained an Overweight rating, projecting 11% growth in Google's core Search ad business for 2025 and a price target of $232.

The consensus price target hovers around $194, suggesting a potential upside of approximately 25% from the current stock price.

Stock Performance and Valuation (Past 12 Months)

Alphabet's stock has experienced notable fluctuations over the past year. Despite a strong Q1 2025 earnings report, the stock remains down approximately 16% year-to-date. However, following the earnings release, shares rose over 4% in after-hours trading. Analysts have raised their price targets, with the average now at $204.34, suggesting a potential upside of around 25% from current levels.

Tackling Challenges: Regulatory and Economic Headwinds

Alphabet isn't sailing in calm waters. The company faces antitrust challenges, with recent rulings declaring its dominance in search and online advertising potentially illegal. Remedies could include divestitures of key products like the Chrome browser. These legal proceedings could impact the company's operations and financial performance. The company is also contending with increased competition from AI-driven search alternatives like OpenAI and Perplexity.

On the economic front, global trade tensions and tariff changes, particularly affecting APAC-based retailers, pose risks to ad revenue. CFO Anat Ashkenazi acknowledged these challenges, noting that changes to de minimis exemptions could create headwinds in 2025.

At Home and Abroad—Two Strategies, One Goal

In the U.S., Alphabet is doubling down on protecting its market dominance through innovation and careful regulatory compliance. Internationally, it’s aggressively expanding infrastructure and customizing products to capture massive global growth opportunities, from India to Africa to Southeast Asia.

Pricing—Friendly, Yet Strategic

Google’s product strategy centers on making AI ubiquitous without alienating users through sudden price hikes. AI enhancements in search and cloud tools are rolled out gently, cultivating deeper user engagement that Alphabet intends to carefully monetize over time.

Keeping Competitors at Bay

Alphabet remains dominant, but aware of challengers. Despite Microsoft's aggressive Bing campaign and Amazon’s advertising growth, Google maintains around 90% global search share. Google Cloud still trails AWS and Azure overall but is closing that gap steadily, bolstered by advanced AI capabilities. The company is also contending with increased competition from AI-driven search alternatives, as stated earlier, like OpenAI and Perplexity. These factors could impact Alphabet's market share and profitability in the coming years.

Operationally, Alphabet’s a Machine

Alphabet’s operational metrics show impressive efficiency—high user engagement, growing revenue per employee (now at about $486k annually), and improved margins. Waymo's rising usage and Google Cloud’s packed backlog are strong indicators of future growth.

Deep Forecasts

Conclusion: Navigating the Paradox

Alphabet's Q1 2025 performance is a study in contrasts. The company is achieving remarkable growth and innovation, particularly in AI and cloud services, while simultaneously grappling with legal challenges and economic uncertainties.

Investors and analysts alike are left to ponder: Can Alphabet continue to thrive amid these headwinds, or will the very innovations that propel its growth also be its undoing?

In the end, Alphabet's journey is emblematic of the broader tech industry's paradox—where rapid advancement and disruption are both the path forward and the obstacles to overcome.