Mastercard Q1 2025: Hitting the Ground Running

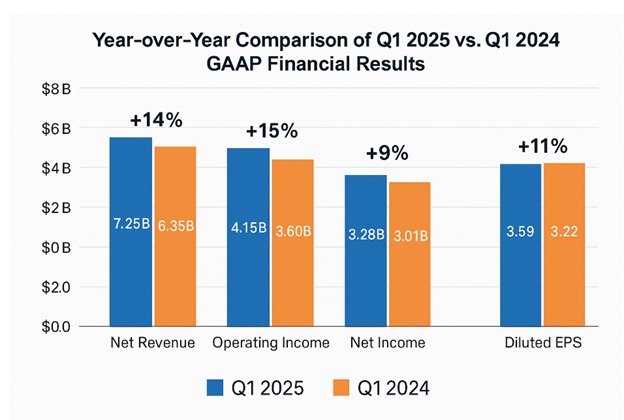

When Q1 2025 rolled around, Mastercard didn’t just raise the curtain—it brought down the house. Net revenue sprang to $7.25 billion, a robust 14.2% leap over last year’s $6.35 billion. What was behind that surge?: a world still itching to swipe—especially abroad, where cross-border volume popped 15%.

Key Financial Metrics (Q1 2025 vs Q1 2024) With YoY Change

| Q1 2025 | Q1 2024 | YoY Change | |

|---|---|---|---|

| 1. Net Revenue (B$) | 7.25 | 6.35 | 14.2% |

| 2. Operating Income (B$) | 4.15 | 3.6 | 15.3% |

| 3. Net Income (B$) | 3.28 | 3.01 | 9.0% |

| 4. Diluted EPS ($) | 3.59 | 3.22 | 11.5% |

Or you could look at it this way:

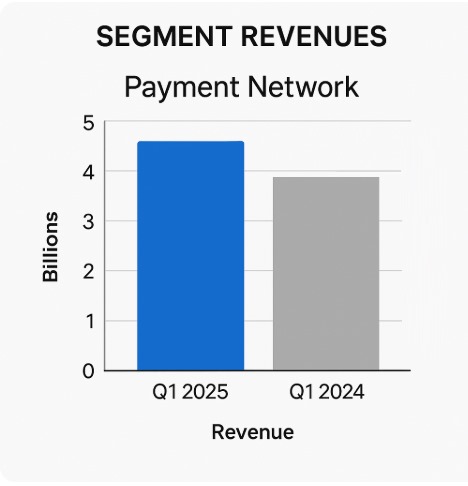

Two Engines of Growth

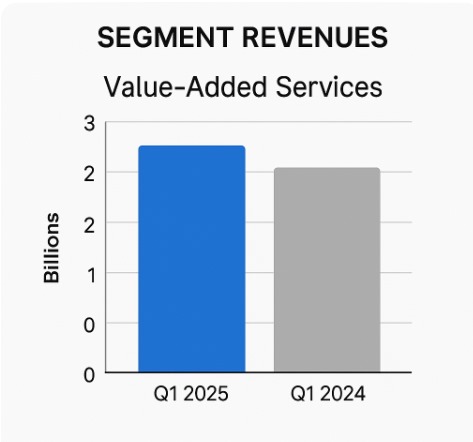

Mastercard’s engine splits neatly into two halves. First, the Payment Network—that’s the bread-and-butter fees on every swipe and tap—clocked $4.432 billion, up 13.1% from $3.920 billion a year ago. But don’t overlook the sprightly upstart: Value-Added Services. From fraud-busting to data wizardry, this arm pulled in $2.818 billion, a 16.1% jump. In short, the company isn’t just processing payments; it’s selling the whole stage show.

Profits that Pack a Punch

Operating income climbed 15.3% to $4.15 billion, revealing some fine expense choreography: marketing and headcount rose, sure, but not enough to crowd the spotlight. Net income paced ahead 9.0% to $3.28 billion, while diluted EPS strutted up 11.5% to $3.59—a hair above the Zacks consensus of $3.57. Sharpen those pencils: tax rates ticked higher (hello, OECD’s 15% minimum), and interest costs bit a bit harder, yet buybacks whispered “EPS boost,” and management kept margins taut at 57.2%. Net income and EPS beats underscore the resilience of Mastercard’s business in the face of a mixed economic environment.

Tariffs, What Tariffs?

Despite headline-grabbing trade battles, actual consumer spending stayed robust. Tariffs have rattled sentiment but haven’t dented card swipes—yet. Management isn’t lowering guidance, but they’re watching cross-border trends closely. Execs admitted sentiment soured under tariff talk, yet actual spending held steady. After all, paying for groceries or grabbing a latte doesn’t obey political whiplash. So far, those steel and aluminum duties haven’t bumped the bottom line—though Mastercard’s team is watching every customs update with hawk-like intensity.

Safety Nets and Strategic Moves

Scan the latest 10-Q and 8-K, and you’ll find several key footnotes: a $151 million litigation reserve for ongoing merchant fee lawsuits (up from $126 million last year), a launched partnership—Agent Pay—with Microsoft and OpenAI to make AI-driven purchases possible, and a collaboration with Corpay to enhance B2B cross-border payments. On the capital front, Mastercard repurchased 4.7 million shares for $2.5 billion and handed out $694 million in dividends, leaving $11.8 billion still earmarked for future buybacks. Meanwhile, the balance sheet remains rock solid, with nearly $8 billion in cash and equivalents plus ample credit lines.

The Street Weighs In

Wall Street critics? More like cheerleaders. Morgan Stanley nudged its price target to $639; Compass Point to $611; and the bullish outlier, Tigress Financial, is betting on $685. With an average target around $620, analysts figure there’s still room to run. They applaud double-digit growth, strategic buybacks, and a moat that even fintech hopefuls struggle to jump.

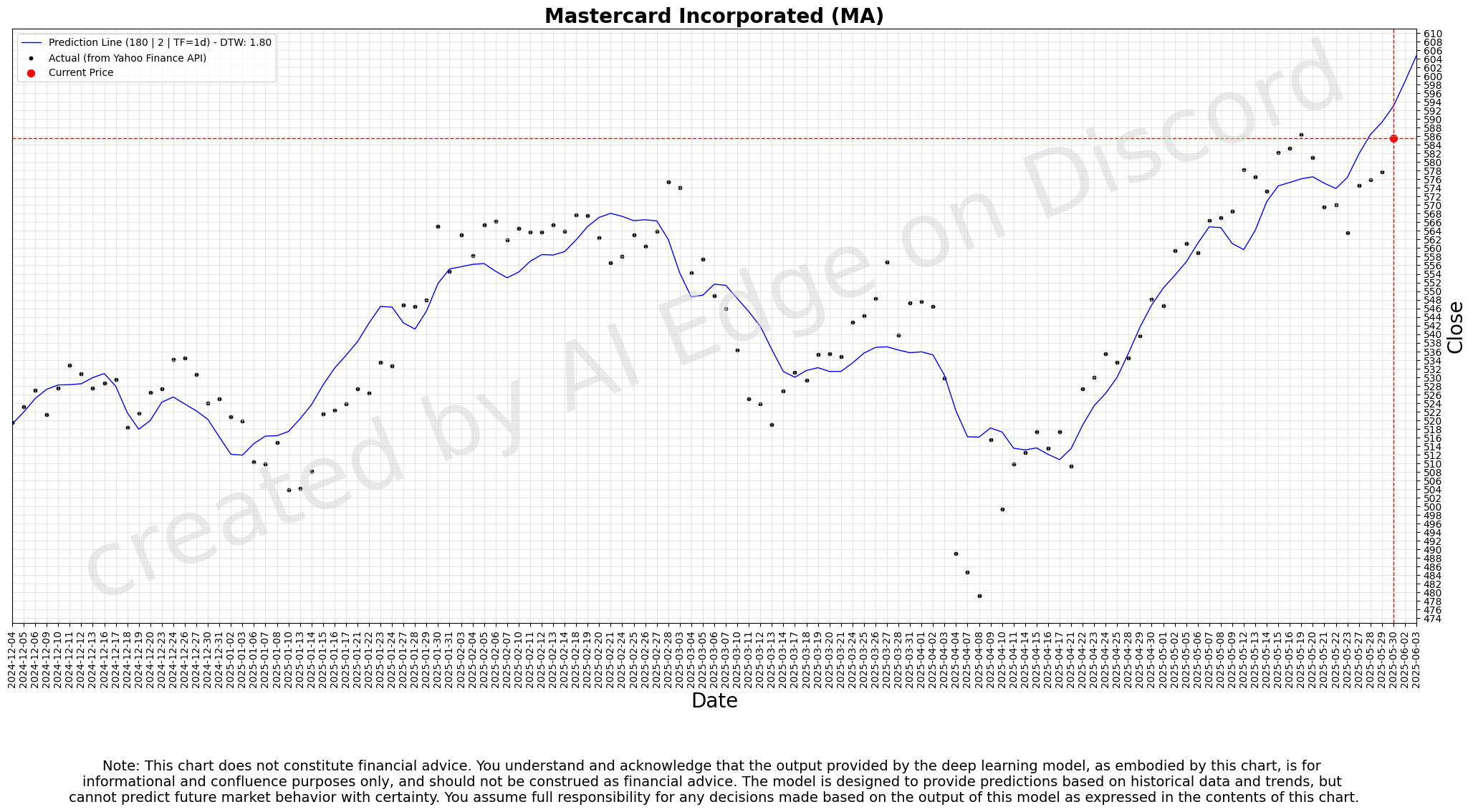

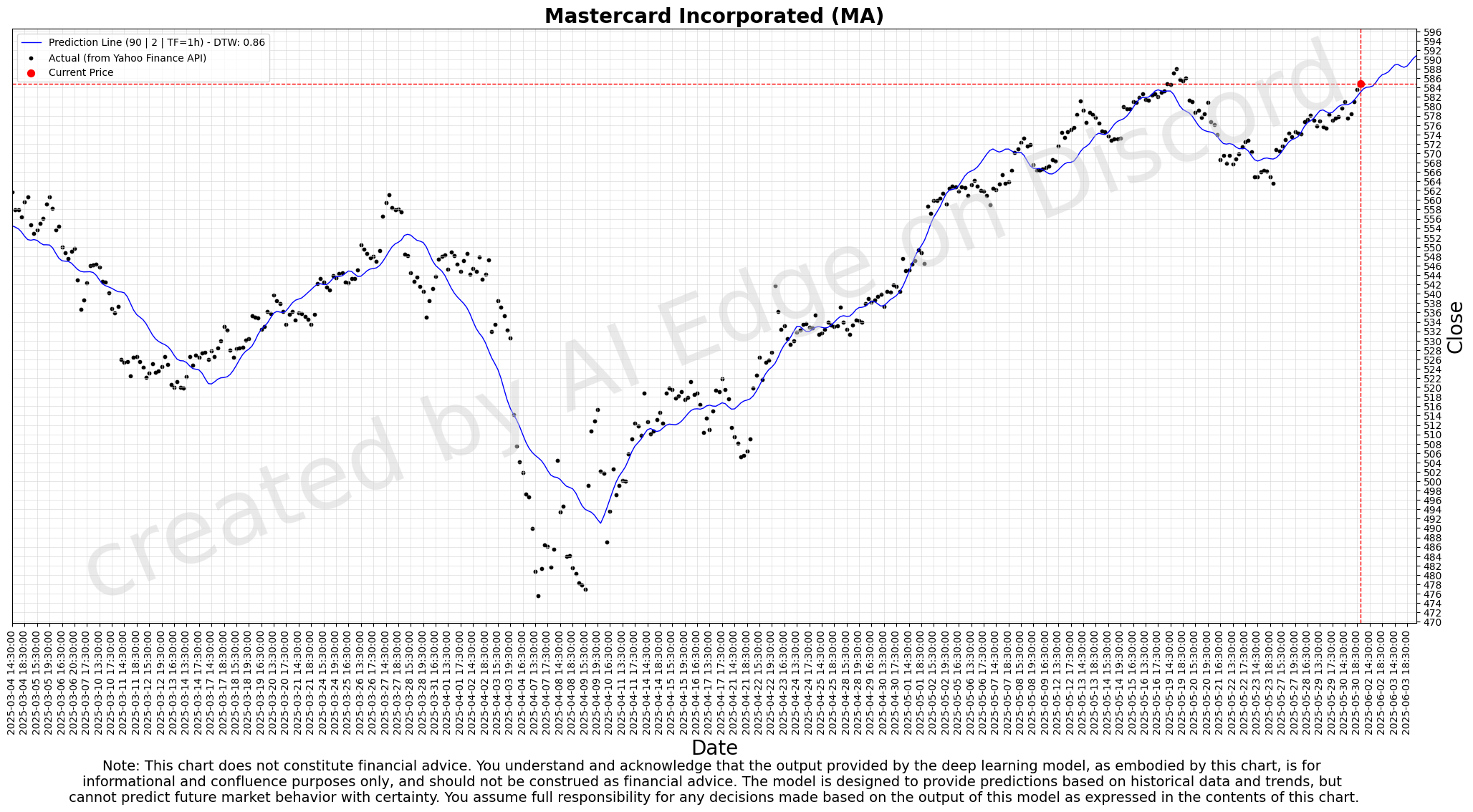

Stock Swagger

Over the past year, MA shares danced from a $428 low to a $582 high—about a 36% encore. Trading near record levels in mid-May, the stock’s forward P/E hovers in the high 30s, a premium ticket price befitting a proven showstopper. Even the S&P’s applause can’t match Mastercard’s performance.

Eyes on the Competition

Against Visa, Mastercard is practically neck-and-neck. Visa, slightly bigger, often edges out steadier growth, while Mastercard plays a bit more aggressively at the margins—whether that’s through faster rollouts of new services or more bullish marketing investments. As for American Express, the comparison is apples to oranges: AmEx runs a closed-loop model focused on premium rewards, whereas Mastercard’s open network boasts far wider acceptance and distribution through partner banks. Fintech challengers—PayPal, Block’s Cash App, and the like—have carved out niches with slick user interfaces, but most of their transaction volume still rides Mastercard rails when customers fund their wallets or use co-branded cards. For every alternative payment method that springs up, Mastercard typically finds a way to integrate, offering fraud protection, data insights, or tokenization to keep everything flowing through its network.

Charting the Road Ahead

Looking forward, Mastercard’s playbook revolves around multi-rail expansion: credit and debit cards, real-time bank transfers, open banking integrations, and even crypto-related solutions. In the U.S., the priority is seizing more B2B volume and winning debit market share—areas where checks and cash still dominate. Abroad, energy is focused on emerging markets in Asia, Latin America, and Africa, where middle classes are growing and cash remains king. Product roadmaps highlight AI-based “agentic” payments, advanced B2B cross-border solutions, and next-generation cybersecurity offerings.

But it’s not just about piling on new services; it’s about maintaining discipline. Operating expenses will tick higher in 2025 as the company invests in talent and technology, but management keeps stressing—grow top line first, then spend. Keep an eye on legal and regulatory developments: antitrust probes in the U.S. and EU could force changes to Mastercard’s interchange or network rules. And watch FX trends: early 2025’s volatile currency swings gave a slight tailwind; if FX stabilizes, volume growth will need to pick up the slack.

Bottom Line

Q1 2025 was less a financial report and more a roadmap:

- Double-digit growth across revenue, income, and EPS

- Value-added services outpacing the core network

- Tariffs presenting more bark than bite

- Investor confidence fueling a premium valuation

If you’re bullish on digital payments and consistent execution, Mastercard’s Q1 results and forward strategy should have you nodding in agreement. The world isn’t switching away from cards anytime soon—and Mastercard has more than one way to make sure every payment finds its way home.