IBM Q1 2025: Navigating Modest Growth, AI Ambitions, and Competitive Currents

IBM just dropped their Q1 2025 earnings report—an event that’s usually about as thrilling as a rerun of Antiques Roadshow, but stick with me because hidden beneath the beige exterior is an intriguing corporate narrative. Let’s dive into IBM’s quarterly adventure through the brave (and occasionally turbulent) seas of enterprise software, hybrid cloud, and generative AI.

Q1 2025 at a Glance: Stability with Subtle Shifts

First, the Financials:

| Metric | Q1 2025 | Q1 2024 | YoY Change |

|---|---|---|---|

| Revenue | $14.5 billion | ~$14.3 billion | +1% (≈+2% CC) |

| Gross Profit Margin | 53.5% | 52.7% | +0.8 pts |

| Pre-Tax Income Margin | 8.0% | 7.5% | +0.5 pts |

| Net Income (Cont. Ops) | $1.05 billion | $1.57 billion | –33% |

| Diluted EPS | $1.12 | $1.69 | –34% |

| Free Cash Flow | $2.0 billion | $1.9 billion | +5% |

Yes, revenue edged slightly upward (thank you, Software segment), yet net income fell 33%—mostly because IBM didn't enjoy the juicy tax benefit from last year. But here's a twist: profit margins actually improved, driven by the richer software mix and productivity initiatives. Free cash flow also nudged upward—IBM ended Q1 flush with $17.6 billion in liquidity, ample enough to weather macroeconomic storms or invest further into its AI endeavors.

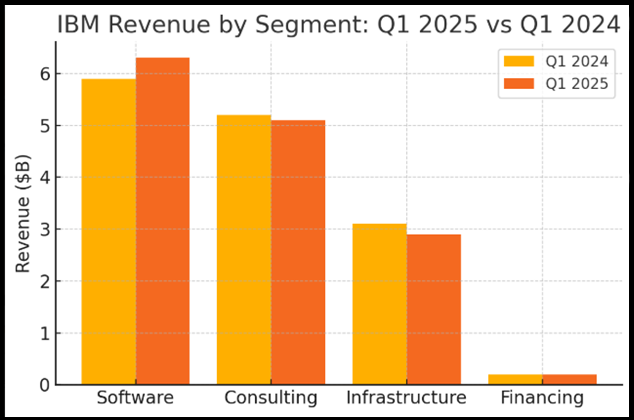

Segment Breakdown: Software Leads, Infrastructure Lags

Let's dissect IBM’s business units using the handy chart below:

- Software: $6.3B (+7%)

- Consulting: $5.1B (-2%, flat CC)

- Infrastructure: $2.9B (-6%)

- Financing: $0.2B (-1%, +2% CC)

Software: Generative AI as the Bright Star

IBM’s Software segment stood out with a 7% growth (9% at constant currency), led by Red Hat’s hybrid cloud (+12%), Automation (+14%), and Data & AI solutions (+5%). Impressively, IBM’s generative AI pipeline ballooned to $6 billion, adding $1 billion just this quarter. The buzz around Watsonx (IBM’s generative AI platform) is tangible—clients clearly crave IBM’s enterprise-grade AI solutions.

But competition is stiff. Oracle’s recent cloud surge (+12%) and Microsoft’s relentless Azure expansion loom large. To counter, IBM dropped $6.4 billion acquiring HashiCorp, boosting its hybrid-cloud muscle. Upcoming acquisitions like DataStax further underline IBM’s commitment to becoming the definitive hybrid cloud software provider.

Consulting: Flat is the New Good

Consulting revenue dipped slightly (-2%), largely flat at constant currency—reflecting macroeconomic jitters and budget caution from IBM’s enterprise clients. The silver lining? IBM is holding steady in a market where giants like Accenture and Infosys are actively cutting forecasts. IBM’s consulting pivot toward AI-driven digital transformation is a strategic bet to rejuvenate growth.

Infrastructure: The Mainframe Cycle Blues

Infrastructure slipped 6%, unsurprisingly linked to the cyclical ebb of mainframe sales (z16 systems peaked last year). IBM's niche strategy here involves bridging the gap between traditional infrastructure and hybrid-cloud demands, notably with its LinuxONE and new hybrid-cloud storage solutions.

Financing: Stable but Small

The Financing segment continues to exist as a supportive function, a financial sidekick facilitating product sales. Nothing flashy here, just steady.

Tariffs and Trade: A Manageable Storm

IBM’s 10-Q filings highlight tariffs as a risk but one that's manageable—so far. IBM has navigated existing trade disputes, integrating tariff considerations into its pricing strategies. However, sudden policy escalations could pinch margins or necessitate price hikes.

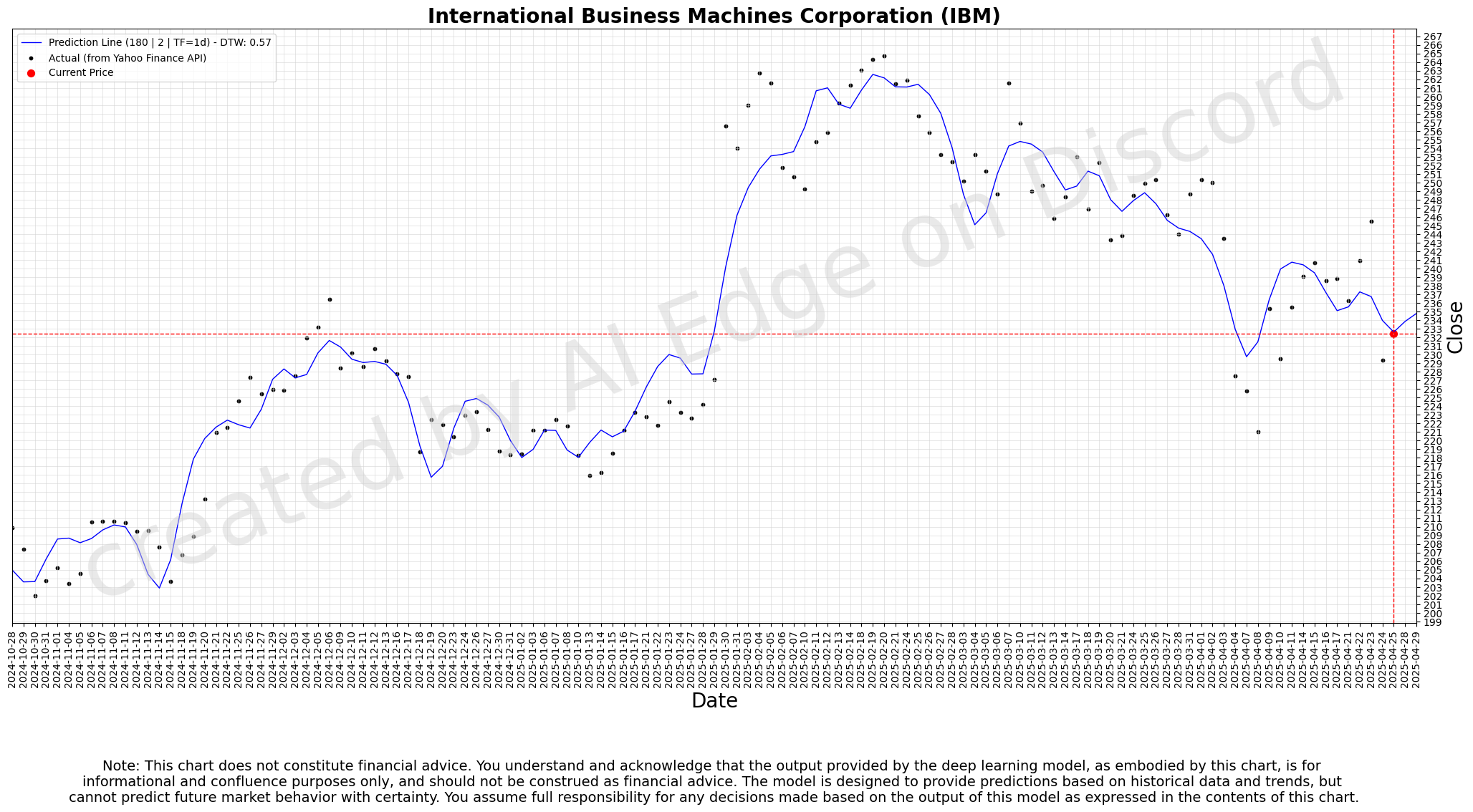

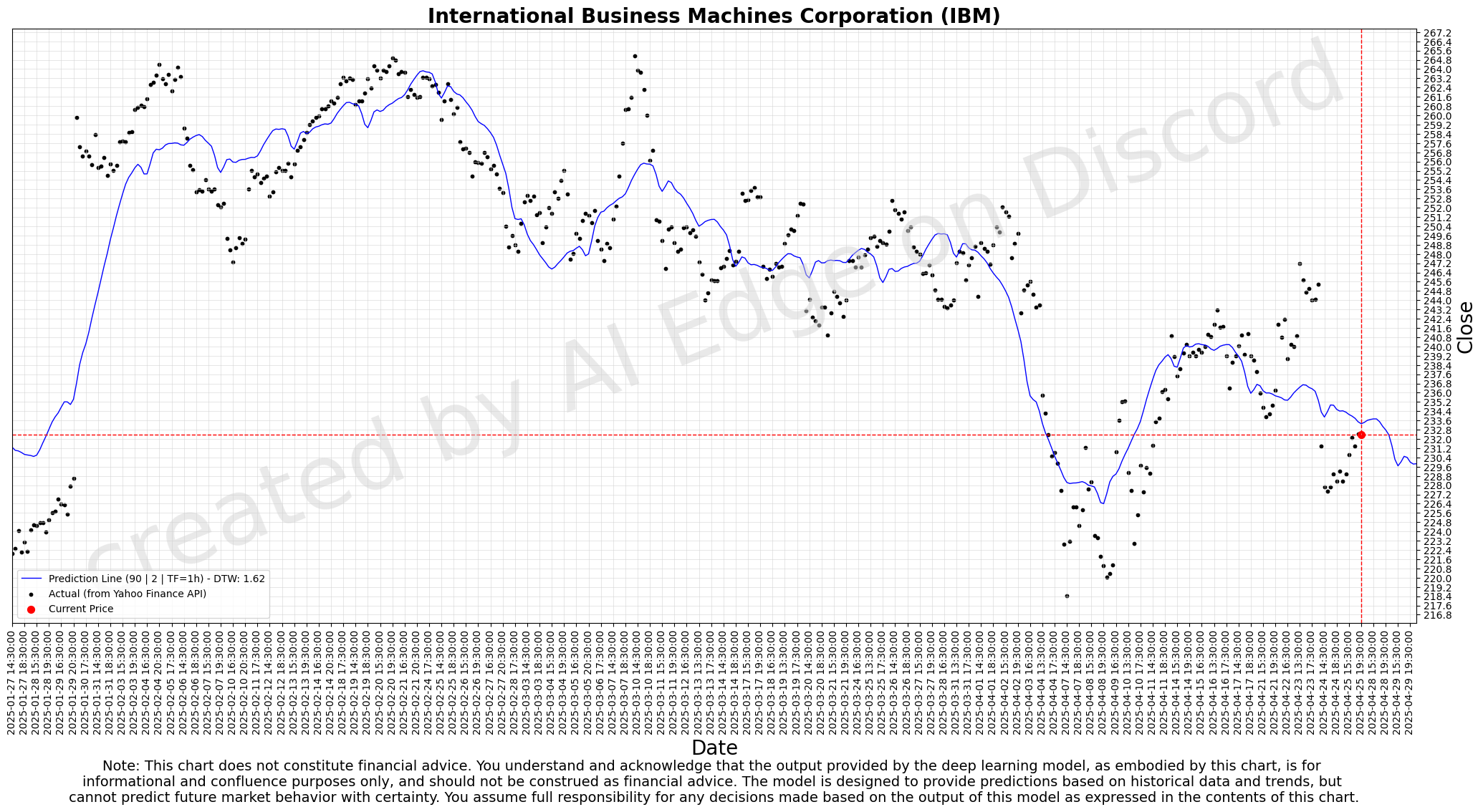

Stock Performance and Analyst Views: Cautious Optimism Prevails

IBM’s stock surged 39% last year, reaching historic highs around $265. Yet, the modest software segment miss sparked a 7% stock drop post-Q1 earnings, highlighting market sensitivity. Analyst reactions are mixed:

- Morgan Stanley: Mild skepticism, target lowered slightly to $233.

- Oppenheimer: Positive but cautious, target reduced to $290.

- Wedbush: Enthusiastic, maintains a bullish $300 target.

Currently hovering around $229, IBM shares remain attractive to value-focused investors and those seeking dividend yield stability (4-5%).

Competitive Landscape and Strategy: Hybrid Cloud & AI as the Defensive Moat

IBM faces fierce rivalry across software (Microsoft, Oracle, SAP), cloud (AWS, Google Cloud), and consulting (Accenture, Deloitte). Its strategic response—anchored in hybrid cloud leadership (via Red Hat) and generative AI innovation (Watsonx)—positions IBM uniquely as both competitor and collaborator, a nuanced posture vital for enterprise buy-in.

Looking Ahead: Execution is Everything

IBM reaffirmed its 2025 guidance (+5% CC revenue growth, $13.5B free cash flow), banking on a stronger second half. Integration of recent acquisitions and execution of the AI strategy will determine if IBM can accelerate sustainably or drift back into episodic growth.

Deep Forecasts

Conclusion: Steady Course, High Stakes

Q1 2025 is emblematic of IBM’s broader transformation—incremental growth, significant strategic investments, and cautious optimism about AI's role in enterprise tech. The narrative, familiar yet nuanced, is now punctuated by generative AI’s potential. For investors and industry watchers alike, the coming quarters will clarify whether IBM’s hybrid-cloud and AI-centric strategy propels it into robust, sustained growth or confines it to modest improvements amidst fierce competition.

Stay tuned, because the IBM saga—much like the broader enterprise AI landscape—is far from dull.

Epilogue: 🧐 Peering Through the Executive Lens: Arvind Krishna’s Unflappable Optimism

There’s a famous phrase attributed to Otto von Bismarck: "Politics is the art of the possible." Arvind Krishna, CEO of IBM, seems to think corporate leadership is the art of holding your nerve. In an economy resembling a toddler on a sugar crash—bouncing unpredictably between "unfazed" and "fetal position"—Krishna has stood at the podium, smiled confidently, and said: "We’re fine." It’s worth unpacking exactly how, why, and what 'fine' even means when your quarter involves AI gold rushes, federal contract slashing, and the ghost of recessions yet to come.

Let’s walk through it...

1. The $6 Billion AI Baby

Krishna radiated optimism about the future, casually tossing out the line: "We remain bullish on the long-term growth opportunities for technology and the global economy." This wasn’t just vague hand-waving. It anchored IBM’s 2025 stance: full-year revenue growth and free cash flow targets remain locked in. If Krishna were a poker player, he just raised the stakes—with a confident grin and a very large pile of chips.

2. Navigating the "Fluid" Economy (While Pretending It’s Fine)

Krishna politely acknowledged that the macroeconomic environment is "fluid," which is CEO-speak for "God knows what fresh hell tomorrow will bring." Still, IBM’s full-year guidance stays untouched: 5%+ revenue growth at constant currency, and ~$13.5 billion in free cash flow. Imagine being on a slightly leaky ship but continuing to host formal dinners—that’s basically IBM’s vibe right now.

3. Clients: Spending, For Now

Client spending, according to Krishna, remains healthy. "We have not seen any material change in client-buying behaviors," he said. Translation: nobody’s panicking… yet. He wisely hedged by noting that uncertainty could cause some pause in purchases—like someone deciding whether to order dessert just in case the stock market crashes tomorrow. But so far, hybrid cloud, automation, and data sovereignty solutions are still priorities, not casualties.

4. Consulting: First Casualty of Caution

Consulting, however, is the canary in the coal mine. Krishna admitted that IBM’s consulting arm is "more susceptible to discretionary pullbacks"—basically, if clients get nervous, the first thing they cut is "strategic transformation initiatives" (translation: "expensive brainstorming sessions"). Indeed, Q1 consulting revenue dipped 2%. However, Krishna made sure to highlight a key contrast: Software stayed strong. Red Hat and transaction-processing software? Still gobbling up revenue like it’s Thanksgiving.

5. Federal Contracts Meet DOGE (No, Not the Cryptocurrency)

In a subplot so surreal it sounds fake: Elon Musk’s “Department of Government Efficiency” (DOGE) cut ~$100 million worth of IBM federal contracts. Krishna treated this news like a minor papercut: annoying, but not fatal. IBM’s consulting backlog is over $30 billion, he pointed out. Plus, most government contracts (veteran benefits processing, payroll systems) are “mission critical”—meaning Musk can cancel a few shiny projects, but he can’t turn off the paycheck machine. In short: DOGE barked, IBM barely blinked.

6. Macroeconomic Outlook: Hopeful, But Ready for Plan B

Krishna also took time to praise the current U.S. administration’s "pro-growth" policies. He even reassured listeners that IBM is not currently forecasting a recession. (Cue cautious golf claps.) However—in classic Big Blue risk management fashion—he outlined a Plan B: if a recession hits, software demand (especially Red Hat and transaction processing) could soften. It’s the corporate equivalent of carrying an umbrella even if the forecast says sunny.

7. AI and Mainframe: The Twin Pillars

Technology demand is where Krishna’s smile turned downright evangelical. Generative AI? Still booming. Clients are moving from "what is AI" to "how can it save me money," which is exactly where IBM’s hybrid AI + infrastructure model shines. And mainframes? The z16 cycle is winding down, but the upcoming z17 is apparently killing it in client previews—especially for security and AI-heavy workloads. Krishna reminded everyone that 45 of the top 50 banks still run on IBM systems. So much for mainframes being "dinosaurs"—they’re more like armored battle turtles: slow, unstoppable, and absolutely necessary.

8. Krishna’s Overall Closing Tone: “We Got This”

In his closing remarks, Krishna basically said: "Look, our business diversity is our superpower." Software, Consulting, Infrastructure��—all humming along, each counterbalancing the others. He expressed strong confidence in IBM’s "next chapter of growth," positioning the company as a stable platform in an unstable world. It’s almost inspiring if you squint past the macroeconomic storm clouds.

Final Thoughts

IBM’s Q1 2025 is a masterclass in calm persistence. Krishna isn’t promising miracle turnarounds, exponential moonshots, or whatever corporate fever dreams are in fashion this week. Instead, he’s offering something much rarer: reliable, diversified growth, backed by a stubborn commitment to execution. In a world addicted to chaos, sometimes the most radical thing you can do is just… stay the course.