Amazon Q1 2025: Prime Results, Tariff Tango, and AWS Magic

Hey, Prime members and Bezos-believers - buckle up, because Amazon just dropped its Q1 2025 earnings, and this quarter is juicier than a Prime Day lightning deal. Amazon reported solid results for the first quarter of 2025, with across-the-board improvements in revenue and profitability. Key financial metrics for Q1 2025 compared to Q1 2024 are summarized below:

The Big Picture: Money, Money, Money!

Key Financial Metrics:

| Metric | Q1 2025 | Q1 2024 | YoY Change |

|---|---|---|---|

| Net Sales | $155.7 billion | $143.3 billion | +9% |

| Operating Income | $18.4 billion | $15.3 billion | +20% |

| Net Income | $17.1 billion | $10.4 billion | +64% |

| Earnings Per Share | $1.59 | $0.98 | +62% |

Amazon raked in a whopping $155.7 billion in net sales this quarter, marking a solid 9% jump from last year's $143.3 billion. Operating income surged 20% to $18.4 billion, net income exploded by 64% to hit $17.1 billion, and earnings per share (EPS) leaped 62%, landing at $1.59. Wall Street analysts are probably dancing in their offices—Amazon didn’t just beat expectations; it smashed them like an overpriced antique during a Black Friday stampede, thanks to relentless efficiency and clever inventory maneuvers.

Segment Deep Dive: The Good, The Great and The Profitable

North America

Let's start with North America, Amazon's bread-and-butter.

- Revenue: $92.9 billion (+8% YoY)

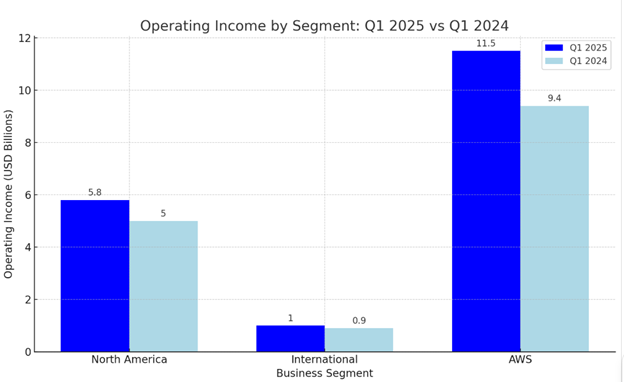

- Operating Income: $5.8 billion (up 17%)

- Drivers: Faster delivery, better inventory placement, and folks buying enough toilet paper and groceries to survive any apocalypse.

Revenue grew 8% year-over-year, hitting $92.9 billion. How, you ask? Faster deliveries, smarter inventory management, and Americans stocking up on enough toilet paper and groceries to outlast any zombie apocalypse. Operating income rose sharply to $5.8 billion, thanks to the company's new obsession with efficiency and automation. Amazon's robots are getting smarter, folks—soon they'll be packing your orders and possibly running for office.

International

- Revenue: $33.5 billion (+5% YoY, +8% without currency drag)

- Operating Income: $1.0 billion (from $0.9 billion)

- Drivers: Profitable growth in tough markets like Europe, and big investments in booming regions like India.

Strong performances in tough European markets and major investments in places like India (watch out, Flipkart) kept things humming. Sure, the International segment isn't a cash cow yet, but at least it's no longer the black hole it used to be.

AWS (Amazon Web Services)

Then there’s Amazon Web Services (AWS)...

- Revenue: $29.3 billion (+17% YoY)

- Operating Income: $11.5 billion (40% margin, up from 38%)

- Drivers: AWS magic continues—despite some slower growth, cloud AI services and cost-saving hardware innovations keep margins deliciously high.

Still the crown jewel, AWS pulled in $29.3 billion in revenue, up 17% from last year. Operating income soared to $11.5 billion, thanks largely to Amazon's relentless push into AI and cost-saving hardware innovations like custom silicon chips. AWS is basically printing money at this point, proving yet again that renting servers to companies chasing the AI dream is a genius business move.

Advertising: (Hidden Gem)

- Revenue surged nearly 19% to $13.9 billion, becoming Amazon’s secret profit powerhouse.

Don’t overlook the Advertising business, Amazon’s secret weapon. It jumped nearly 19% to $13.9 billion, quietly becoming a huge profit driver. Every click on a sponsored product is essentially pure margin. Sneaky Bezos strikes again!

Other Businesses:

While AWS and Advertising might steal the spotlight, Amazon's other businesses quietly kept the engine humming in Q1 2025.

Third-Party Seller Services

- Revenue growth likely in double digits, driven by steady marketplace expansion.

- Third-party sales consistently around 60% of total units, fueling healthy commission and fulfillment fee growth.

Subscription Services

- Healthy revenue increases due to continued Prime member growth.

- Boosted by a recent Prime membership price hike in Europe (because who says convenience comes cheap?).

Physical Stores (Whole Foods & Amazon Fresh)

- Revenue reached $5.53 billion, marking a modest but consistent 6% growth year-over-year.

- Steady, albeit quiet, progress in brick-and-mortar grocery.

Online Store Sales (Amazon’s Own Products)

- Solid sales of $57.4 billion, reflecting steady 6% year-over-year growth.

- Continued consumer trust and robust online shopping behavior.

All these “other” revenue streams reinforce Amazon’s broader ecosystem—more Prime members, bigger marketplace variety, and reliable grocery sales—proving once again that Amazon’s diverse strategy is paying off nicely.

Tariff Tango: Dancing on Trade Troubles

Tariffs are Amazon’s latest wild card. Consumers went on a buying spree, fearing tariff hikes, giving Q1 a nice boost. But tariff clouds loom over Q2, with Amazon prepping by diversifying supply chains and loading up inventories early. Whether tariffs become friend or foe, Amazon is strategically positioned to handle the turbulence.

Analyst Whisperings and Stock Swings

Analysts, usually cautious creatures, remain bullish. Morgan Stanley bumped its price target up to $250, Bank of America kept a firm $225, JPMorgan held steady at $220, and even HSBC, cautious about tariffs, set a target at $240 (down slightly from $280). Clearly, Wall Street sees plenty of upside - assuming the tariffs don't crash the party.

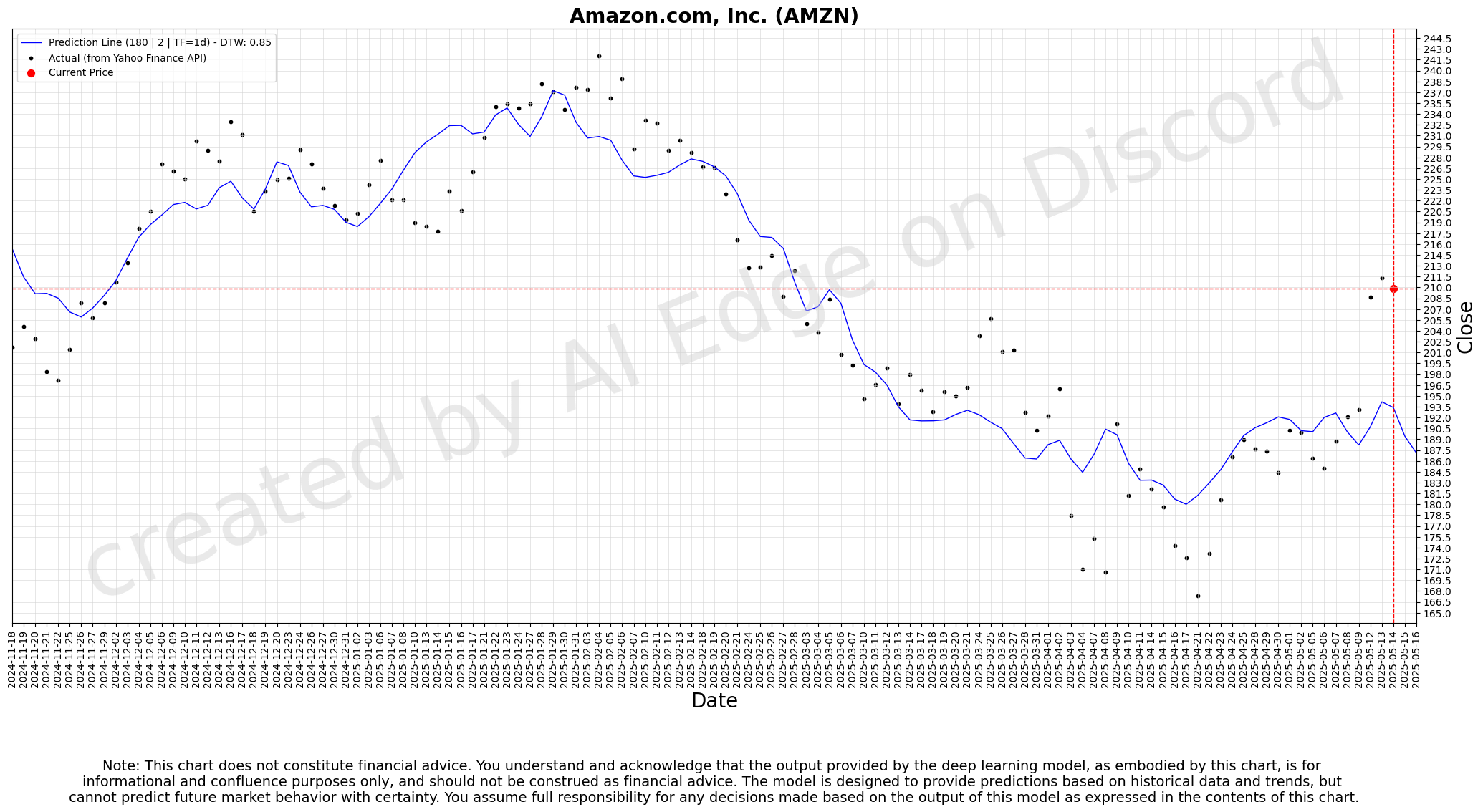

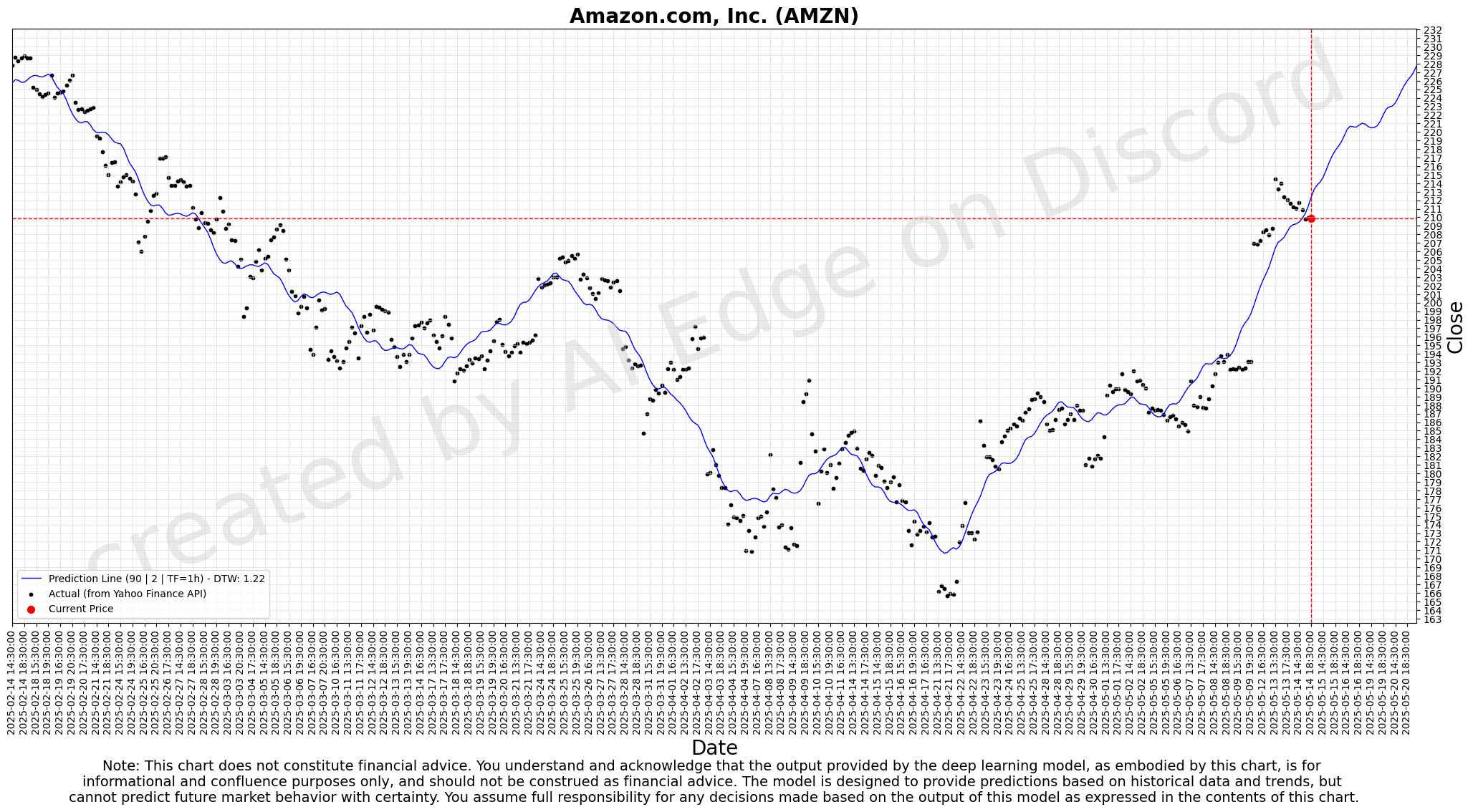

Speaking of parties, Amazon’s stock has been on a rollercoaster. Over the past year, shares have swung dramatically between a high of roughly $243 and a stomach-churning low of around $152. Right now, the stock sits comfortably at around $211. Investors holding on tight for the long-term ride have seen modest returns, with the stock currently down about 5% year-to-date but up nearly 12% over the past 12 months. Keep those seatbelts fastened, folks.

Strategic Moves: How Amazon Plans to Keep Dominating

Retail (U.S.)

- Keep expanding product range and squeezing out rivals with faster deliveries and bigger discounts. Expect more Prime Days and retail events.

Logistics

- Regional fulfillment and aggressive logistics automation mean faster, cheaper deliveries nationwide. Goodbye, UPS trucks—hello Amazon drones?

On the retail front, Amazon isn’t resting. It’s pushing hard on faster deliveries, expanding product selection, and adding more Prime Days (because who doesn’t love discount shopping?). The fulfillment network is getting a turbo boost, with fewer UPS trucks and possibly more drones zipping around delivering your impulse buys.

International Markets

- New marketplaces opening (hello, Ireland!) and deeper penetration into India, where Flipkart better watch its back.

Internationally, Amazon's planting flags in new territories like Ireland and diving deeper into high-growth markets like India, giving local competitors something to worry about. Meanwhile, AWS is doubling down on AI, positioning itself as the ultimate cloud service provider for companies eager to ride the AI wave.

AWS & AI Magic

- AWS is betting big on AI at all levels of the stack such as generative AI services and efficient custom silicon (Trainium chips for training models which offer 30–40% better price-performance than GPUs). It is also investing heavily on managed AI platforms like Amazon Bedrock (which hosts various AI models for customers). Companies like Uber, Boeing and Nasdaq already hopped aboard the AWS train.

Advertising

- Scaling video ads and data-driven sponsored content, capturing ad budgets from Google and Meta. (Yes, Amazon Ads are secretly everywhere.)

The advertising division will continue expanding aggressively, siphoning ad budgets from giants like Google and Meta by offering irresistible deals on targeted ads. Prime membership perks keep multiplying, locking customers into Amazon’s ecosystem tighter than your aunt’s holiday sweater.

Prime Ecosystem

- Prime memberships now pack more perks than Santa’s sack, locking customers into the Amazon ecosystem for life.

Amazon vs. the World: Competitive Showdown

- Walmart: Amazon plans to compete on convenience and selection (and match them in the grocery sector) via deeper Whole Foods integration and relentless convenience.

- Alibaba & Temu: Tariff changes might defang Chinese import rivals—advantage Amazon.

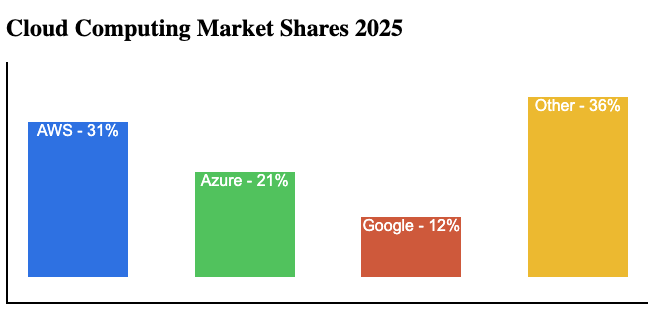

- Microsoft & Google (Cloud Computing): AWS staying ahead with relentless innovation in AI and hybrid cloud solutions.

What’s Next?

Expect Amazon to:

- Expand Prime same-day delivery everywhere.

- Push hard into international markets.

- Drop some serious AI announcements at AWS re:Invent 2025.

- Possibly scoop up a strategic AI or logistics acquisition.

Bottom Line: Prime Still King, AWS Still Printing Money

Despite cautious forward guidance and tariff uncertainties, Amazon is cruising along. Strong Q1 performance, savvy inventory tactics, and relentless innovation suggest Amazon remains perfectly poised to handle whatever the economy throws its way.

Stay tuned, folks—this retail-cloud-advertising-AI behemoth shows no signs of slowing down.