Meta Q1 2025: When Ad Dollars Meet AI Dreams

Meta’s Q1 Encore

If Q1 2025 were a feature film, it’d open with triumphant brass: record revenue, eye-popping profits, and a surprise twist—massive capex burning like popcorn in the data-center oven. If you tuned into Meta’s Q1 2025 earnings, you might have mistaken the numbers for a blockbuster sequel—revenues up 16%, net income on steroids (+35%) and EPS that left consensus estimates in the dust (a hefty $6.43 vs. $5.25 expected).

First, Your Cheat-Sheet Table: Q1 2025 vs. Q1 2024, featuring the YoY plot twist in the final column:

| Metric | Q1 2025 | Q1 2024 | YoY Change |

|---|---|---|---|

| Revenue (B) | $42.314 | $36.455 | +16% |

| Operating Income (B) | $17.555 | $13.818 | +27% |

| Net Income (B) | $16.644 | $12.369 | +35% |

| EPS ($) | $6.43 | $4.71 | +37% |

| Free Cash Flow (B) | $10.334 | $12.531 | –17.6% |

- Meta crushed the $41.3 B revenue consensus and delivered a tax-benefit–fueled net margin approaching 39%.

- EPS growth of 37%—that’s a mic-drop on Wall Street.

- Free cash flow dipped as Meta doubled down on its AI and infrastructure binge.

Meta buried itself in data-center CapEx. If this quarter were a cocktail, it’d be two parts record profit, one part hyper-investment and a garnish of mega-infrastructure.

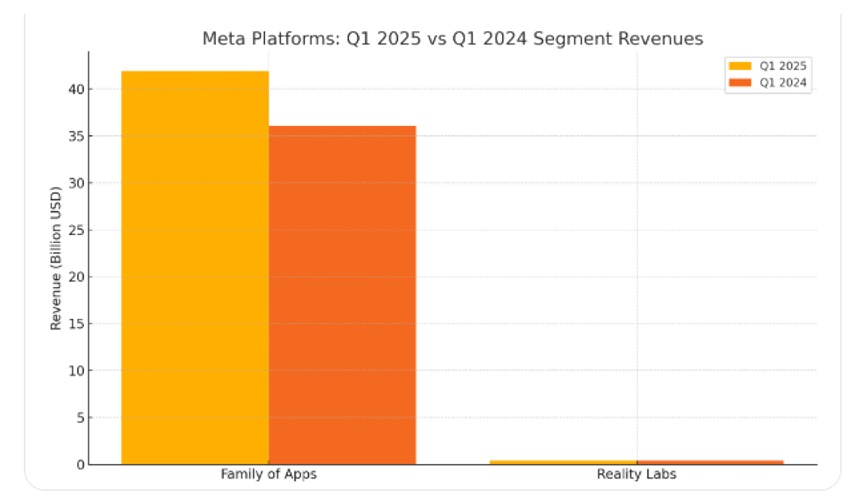

Family of Apps vs. Reality Labs: Cash Cow and Cash Drain

Meta now runs two very different businesses:

- Family of Apps (FoA): The $42 billion cash cow—pounds out 99% of group revenue and boasts a monstrous 52% operating margin.

- Reality Labs (RL): The $400 million fringe experiment—hemorrhaging over $4 billion per quarter on VR/AR dreams.

The Segment Revenues chart only hints at the dramatic disparity: FoA revenue soared from $36 billion to $41.9 billion, while Reality Labs slipped from $440 million down to $412 million. RL’s operating loss actually deepened slightly, even as Zuckerberg insists each Quest and smart-glasses prototype edges us closer to that fabled metaverse.

Simply put, FoA is the cash juggernaut (52% segment margin!), while RL still racks up a $4 B quarterly R&D tab in pursuit of the metaverse. But don’t let the profit party distract you: CapEx surged to nearly $13.7 billion, doubling the prior year’s infrastructure spend. Meta is burying its cash under racks of AI servers and data-center cooling, betting those investments will fuel the next decade of growth.

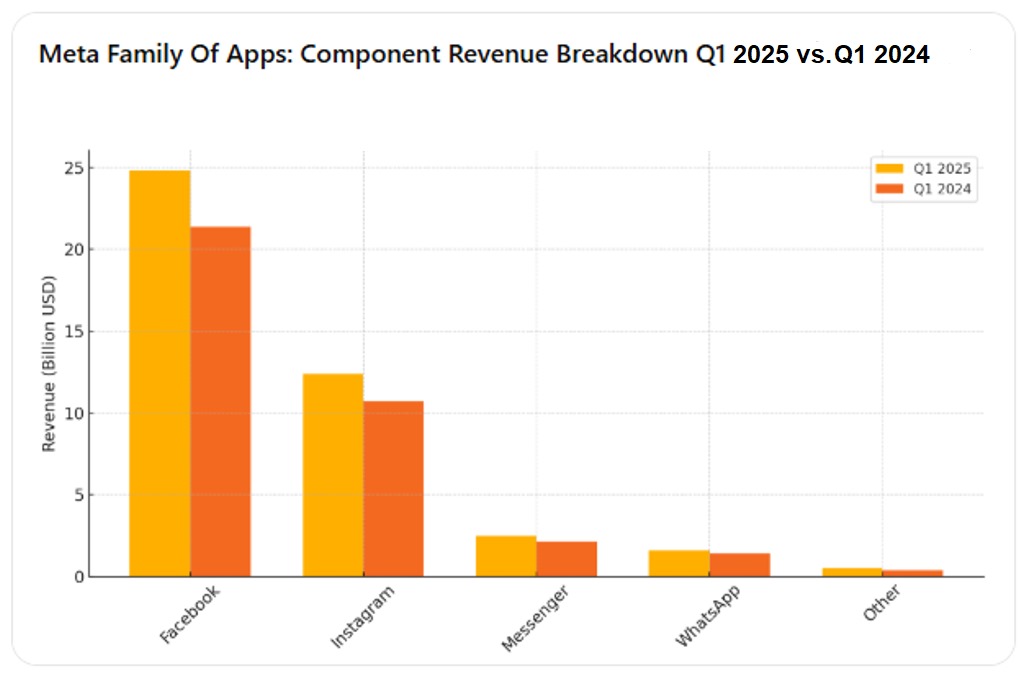

Family of Apps Revenue Components

Here's a detailed breakdown:

1. Facebook (~60% of FoA Ad Revenue, ~$24.8 B)

- Strengths: Highest ARPU (~$11.50 per MAU per quarter), mature markets (North America ARPU > $50), advanced AI targeting.

- Growth Drivers: New Reels ad formats, expanded Marketplace advertising, more in-stream video ads.

2. Instagram (~30%, ~$12.4 B)

- Strengths: Younger demographic, high engagement on Reels, strong e-commerce features (Shopping tags, Instagram Checkout).

- Growth Drivers: Reels monetization improvements, expanded influencer and brand partnerships, AI-powered creative tools.

3. Messenger (~6%, ~$2.5 B)

- Strengths: Deep integration with Facebook News Feed and Instagram; growing Business API usage.

- Growth Drivers: Click-to-Messenger ads, sponsored message campaigns, developer platform fees.

4. WhatsApp (~4%, ~$1.6 B)

- Strengths: Ubiquitous in India, Brazil, Europe; trusted end-to-end encryption.

- Growth Drivers: WhatsApp Business API charges, pay-per-message fees for enterprise customers, click-to-WhatsApp ads.

5. Other Revenue ($0.51 B)

- Covers things like Portal hardware sales, paid tools for developers on Messenger and Instagram, and early subscription/verification tests (e.g. Meta Verified). While small today (~1.2% of FoA), this bucket grew ~34% YoY and signals Meta’s push to diversify beyond ads.

Why It Matters:

- Facebook’s cash cow continues to bankroll Meta’s AI and Reality Labs bets.

- Instagram’s rapid Reels rollout is key to capturing TikTok-style engagement and ad dollars.

- Messaging-based commerce (Messenger & WhatsApp) is an emerging frontier—critical outside North America where apps like WeChat already monetize heavily via payments and services.

- “Other” revenues won’t replace ads soon, but they’re expanding Meta’s monetization playbook.

Together, these apps form a diversified ecosystem: the mature feed of Facebook, the dynamic video canvas of Instagram, and the transactional potential of Messenger and WhatsApp. That synergy is why Meta’s Family of Apps still accounts for 99% of its total revenue—and why understanding each app’s role is crucial to forecasting Meta’s next moves.

Advertising and Audience: The Power Couple

- Ad pricing power: Prices per ad jumped +10% YoY, outpacing impression growth (~+5%), a sign that advertisers will pay up for Meta’s proven ROI.

- User metrics: 3.43 billion daily active people (+6% YoY)—enough eyeballs to make even the savviest marketer salivate.

- G&A cost cuts: Administrative spend down 34% YoY—legal fees in Q1 2024 apparently featured more popcorn-worthy courtroom drama.

Behind the scenes: Reels is grabbing time and ad dollars, and WhatsApp Business is quietly evolving into a micro-commerce monster.

Expense Discipline… Plus a CapEx Inferno

- G&A: –34% YoY (goodbye, blockbuster-sized legal fees of 2024).

- R&D: 28.7% of revenue, up from 27.4%.

- CapEx: ~$13.7 B in Q1 (vs. $6.7 B last year), focused on data centers and AI hardware.

Operating leverage shines—expense/revenue ratio improved from 62.1% → 58.5%—but cash is flying out the door to future-proof Meta’s AI ambitions.

Tariffs, Regulators, and Other Plot Twists

- China-U.S. tariffs? So far, no hiccups—Asia-Pacific ad sales grew +12% in Q1 2025.

- EU Digital Markets Act threatens to force ad-free subscriptions or unbundle data by Q3 2025.

Despite eyebrow-raising chatter about U.S. tariffs on Chinese ecommerce giants (Shein, Temu), Q1 ad revenue growth stayed robust across regions. Meta’s guidance for Q2 ($42.5 B–$45.5 B) winkingly acknowledges “a dynamic macro environment,” i.e., “Don’t blame us if trade wars get spicy.”

On the regulatory front, the EU’s Digital Markets Act looms like a plot twist—Meta may have to unbundle data or offer ad-free subscriptions without personalized advertising, potentially crimping European revenue by Q3 2025. Cue suspenseful music.

Meta’s Q2 guide of $42.5–45.5 B is wrapped in cautious optimism, acknowledging that trade and regulation may still throw curveballs.

Wall Street’s Standing Ovation (…and a Standing Check of Stock Performance)

JPMorgan, Wells Fargo, Citi, and the chorus of AI-bull analysts nearly synched on higher price targets—in some cases in the high $700s. They cheered Meta’s AI roadmap, ad returns, and disciplined spending, even if CapEx feels like drinking from a firehose. Meta’s stock already flirted with all-time highs earlier this year, and after Q1’s results, it shot up another 5% in after-hours trading. The market seems to think Meta’s heavy investment is worth the price.

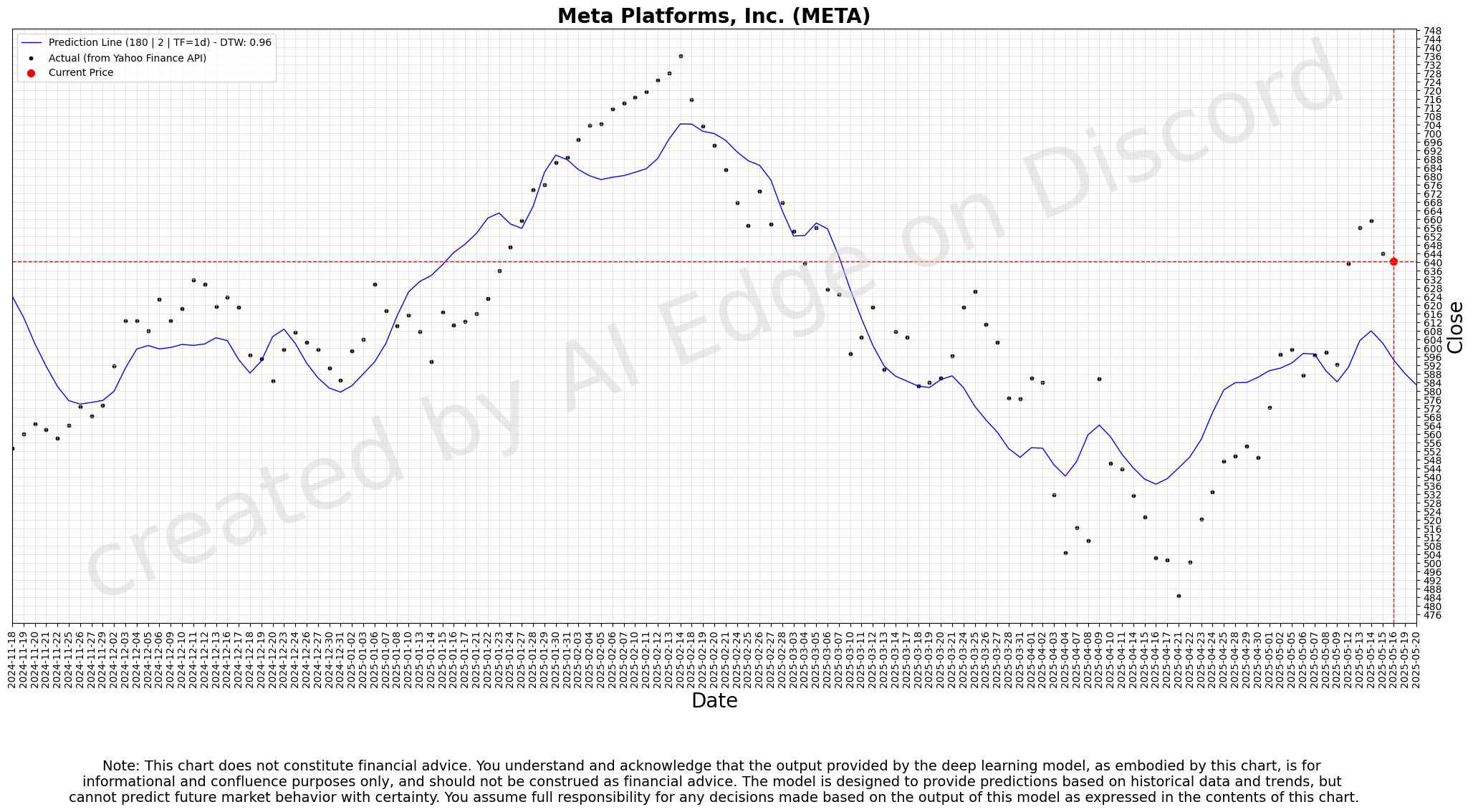

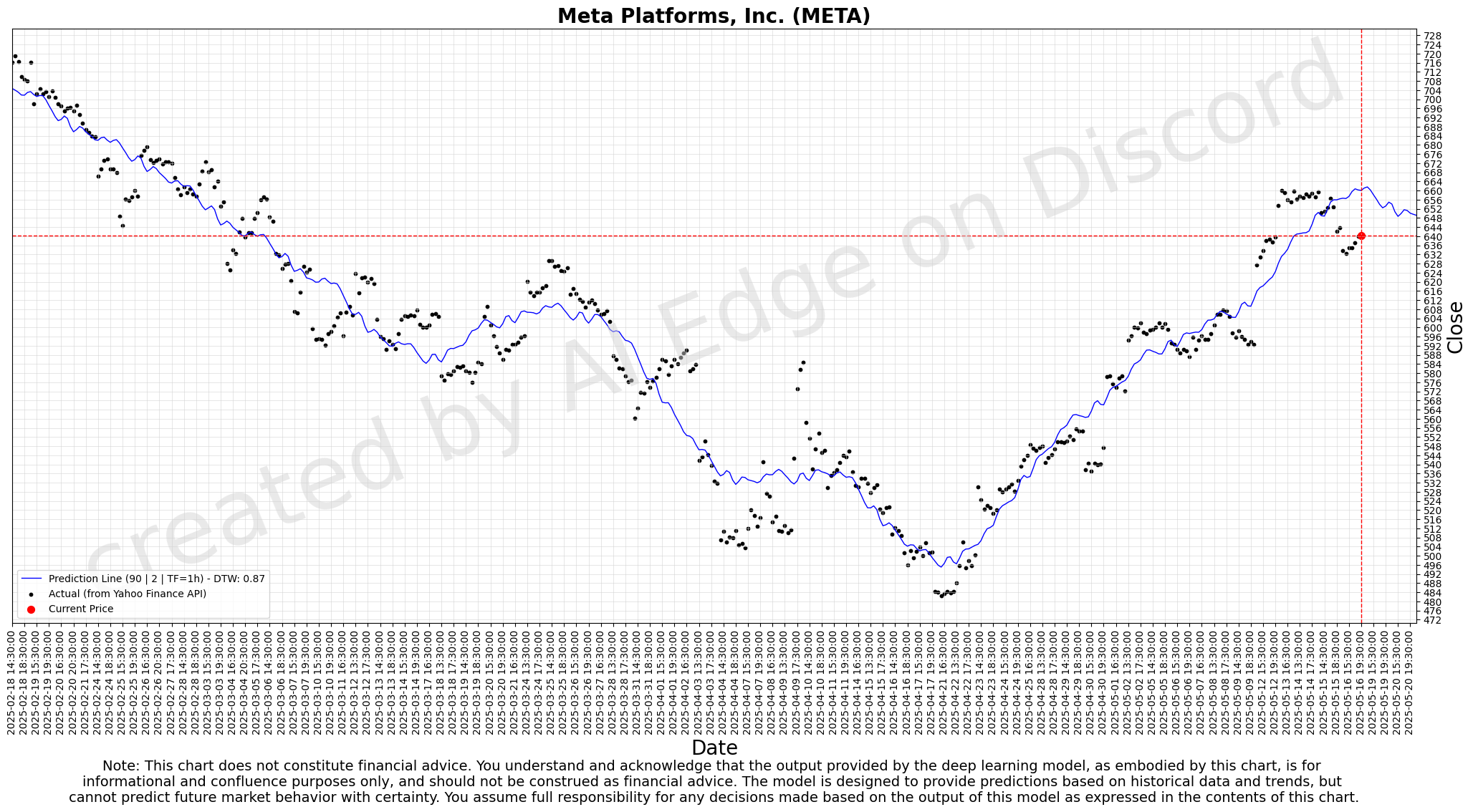

Stock Performance (Past 12 Months)

- 52-week low: $442.65 (Jul 2024)

- 52-week high: $740.91 (Feb 2025)

Investors reacted very positively to the Q1 report. Meta’s stock jumped over +5% in after-hours trading immediately following the earnings release. The next day, shares continued to climb. As of mid-May 2025, Meta stock trades around $650+ per share, up from the mid-$500s range just before earnings. Over the past year, the stock has seen a tremendous run: the 52-week low was about $442.65 (in July 2024) and the 52-week high was $740.91 (in February 2025). In fact, Meta hit an all-time high in the $740s this February before a tech stock pullback. Even after that dip, the stock is roughly 40–50% higher than a year ago, vastly outperforming the broader market. Year-to-date in 2025, Meta had been down about 7% prior to earnings (due to the early-year pullback from the peak), but the post-earnings surge erased those losses. This volatility reflects changing sentiment on macro conditions and spending—for instance, concerns over tariffs and higher CapEx contributed to the spring decline—but the long-term trajectory has been strongly upward as Meta proves the resilience of its ad business.

Looking Ahead: Five AI Pillars and Beyond

Meta’s investors sat up straighter when management sketched five pillars of AI-driven growth:

- Ads That Think: Advanced targeting, real-time conversion insights, AI-generated creatives, and yes—higher pricing.

- Unlimited Scroll/Stickier Feeds: Smarter Reels/Stories recommendations fueled by next-gen Llama models—keeping it more addictive.

- Business Messaging: WhatsApp becomes the next big commerce channel—imagine booking flights via a chatbot that knows you too well.

- Meta AI for Consumers and Creators: Nearly 1 billion monthly users of its Meta AI assistant already—text prompts to images to chatbots, all in the palm of your hand.

- Wearable Worlds: Quest 3 under $500, Ray-Ban smart glasses, and whispers of Apple-style AR spectacles. Meta wants your next screen to be strapped to your face.

Global Stage & Competitive Cameos

- U.S./Canada: Solid engagement, Threads at 320 M MAUs (monetization slated for later).

- Europe: Engaged in regulatory hopscotch—subscription pilots vs. DMA mandates.

- Asia & Emerging: E-commerce integrations, regional AI content, and WhatsApp payments.

Competitors: TikTok, Snap, Apple Vision Pro, Google AI.

- Meta’s edge?: Scale, relentless iteration, and now a deep bench of proprietary AI.

International strategies vary—from shoring up Europe against regulatory headwinds to monetizing WhatsApp in India and Brazil. Domestically, Threads quietly amassed 320 million users, a text-first play that Meta insists won’t be monetized in 2025—but don’t be surprised if it reappears as an ad vehicle once the bugs are ironed out.

Areas to Watch

- Free Cash Flow: Will Meta’s $70 billion in cash reserves and flexible buyback authorization be enough to balance the CapEx binge?

- Reality Labs losses: Can one day-dream fuel those $4 billion quarterly deficits into a sustainable business, or will the metaverse hit a road bump?

- Regulatory surprises: European rules and potential U.S. privacy legislation could reshape the ad empire.

- Competitor moves: TikTok’s ban talk boosts Meta in the short run, but Apple’s Vision Pro and Google’s AI could challenge in the long run.

Curtain Call

If Meta’s FoA were a Broadway show, it’d be a smash hit running for decade—sold-out crowds, rave reviews, and a standing ovation every quarter. It’s the profit juggernaut funding Meta’s wildest sci-fi bets in Reality Labs and AI. While we watch the metaverse prototypes sputter, FoA’s cash tide keeps rising, turning Meta into one of the few tech giants that can simultaneously rake in billions and burn billions on tomorrow’s dreams.

Internationally, Meta will tailor its approach to each region—whether that’s pushing WhatsApp commerce in India or complying with strict rules in Europe—but the overarching aim is to keep the Family of Apps indispensable to billions of people while methodically building the next generation of platforms. Given the Q1 results and current trajectory, Meta enters the remainder of 2025 with strong momentum and confidence. If it executes on these plans, it could sustain double-digit growth and further strengthen its competitive moat, though investors will be watching how effectively Meta balances growth vs. spending and navigates external risks in the coming quarters.